By Marisol Rodriguez, LDO, ABO-AC, NCLEC

As opticians, we take pride in knowing that the needs and wants of the patient are met and executed successfully. Sometimes that can mean multiple pairs of eyewear or unforeseen services or treatments the patient wasn’t expecting. When I read Linda Conlin’s continuing education article, “Easy Steps to More Eyecare, Eyewear and Patient Satisfaction,” I was excited to see this subject addressed. With a flexible payment option like Sunbit, the patient doesn’t have to think about what they may need to sacrifice because they don’t have the funds available that day. And the optician can feel more confident discussing solutions to all the visual challenges the patient is facing.

When I was working at a clinic/dispensary, I learned quickly that a person can have more than one ocular health issue or need separate ophthalmic devices for proper and comfortable vision correction. It was often difficult to address most of their needs because of finances, so they would choose to do one thing and unfortunately struggle with another. Having Sunbit as a “Buy Now, Pay Later” (BNPL) option made these conversations and implementation much easier. Here are a couple of real scenarios in which I successfully fit the patients to meet all their needs.

A family of four came in for their routine exams, with the twins getting ready to be freshmen at an out-of-state college. They had routine optical coverage, and their mom had her flexible spending account (FSA) to cover any overages. Everyone wears glasses and/or contacts. It was important for the kids to get new glasses and a year’s supply of contacts each to leave with. When it was time for their dad to have his exam, the doctor discovered his tonometry was much higher than usual. The exam for him quickly turned into a medical evaluation. They hadn’t met their medical deductible. To add to this, the mom just got a great new job a few months back working from home, and she realized that magnifiers weren’t cutting it anymore. She couldn’t function well for an 8 to 10 hour day behind her desk and now needed an occupational pair of glasses. Everyone’s needs had to be met. Even with their optical coverage, health insurance and their FSA, the total was more than what they were prepared to pay that day. I took the opportunity to mention Sunbit to them, how it was an easy application process and wouldn’t be a hard inquiry on their account. It offered them the opportunity to pay off the total over a period of time, so everyone’s needs could be met. The parents had a sigh of relief and thanked me for offering them this opportunity as they were overwhelmed trying to get the kids off to school, and all the expenses that kept piling up. Another perk was, since New York is a state where eyewear is tax deductible, they could submit the statement from Sunbit to their accountant at the end of the year.

In another scenario, I had a long-time patient who was 27 and graduated from a university. They are now financially independent and were coming in for the first time without their guardians for a purchase. They were starting a new job and wouldn’t be getting optical coverage for another 90 days. Their most recent pair of glasses broke during a volleyball accident, and their backups had seen better days. They found their perfect pairs and fell in love with the glasses and sunglasses. They were extremely light sensitive and had an early hour-long commute into work, so it was important to have both pairs. I could sense they felt a little disappointment, and they finally disclosed they were going to have to struggle for a few months. I took this opportunity to mention the flexible payment plan Sunbit as a solution. They were over the moon because they didn’t know this was an option. They quickly applied and were approved. They were elated that they could have exactly what they wanted and thanked me for mentioning Sunbit to them. They came back a few months later with their vision coverage and were fit for contact lenses. They decided to opt out of an FSA and used their Sunbit account again to pay for the overage fees.

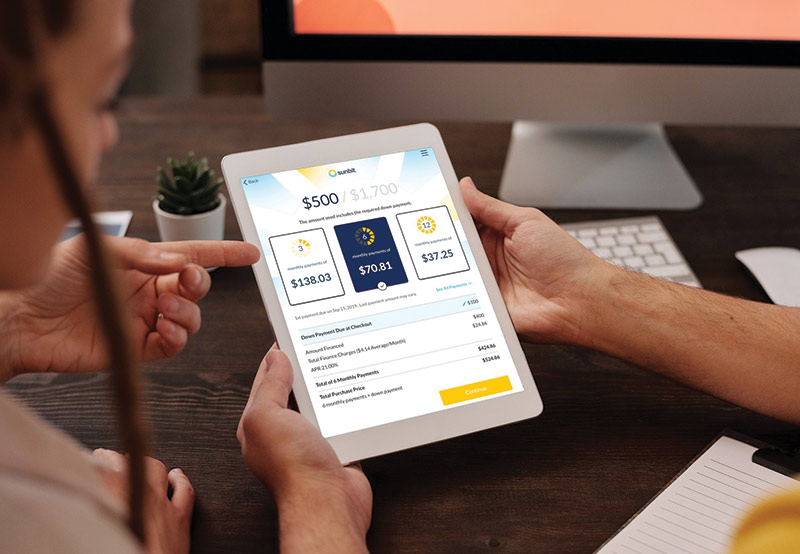

Every practice should incorporate a BNPL option such as Sunbit technology. It’s a quick, transparent and easy application process. There are so many services and products that can augment the patient and provider experience—incorporating Sunbit into your transaction is yet another opportunity to do so.