Despite continued uncertainty about the economy and the resulting consumer reluctance to buy, the findings of 20/20’s 2010 Sunwear Survey of Independents conducted in November 2010 point toward some warming trends. In fact, 67 percent of survey participants report their Rx sun business is on the rise, up from the 59 percent who cited an increase in 2009. However, respondents to the current survey expect sunwear products to account for only 8 percent of gross retail dollar sales in 2010—the same percentage reported in 2009. What’s especially significant is the average price of a complete pair of Rx sunwear per patient (including frame and lenses, but excluding the exam) was $324 in 2010, comparable to the $327 cited for a complete pair of eyeglasses. Indeed the vast majority of Rx sunglasses (nearly 79 percent) dispensed by the surveyed independents in the past year retailed on average for more than $200 and nearly 22 percent sold for an average in excess of $400.

THE SUNNY SIDE

THE SUNNY SIDE

Clearly there’s still sizzle in the sunglass business, which is reflected in a variety of statistics. Consumers appear to be more knowledgeable about sunwear products than they were in the past with 62 percent of the respondents saying their customers/patients are better informed about sunwear products than they were five years ago. The advantage of better educated customers is they are often willing to purchase premium products that have increased functional benefits.

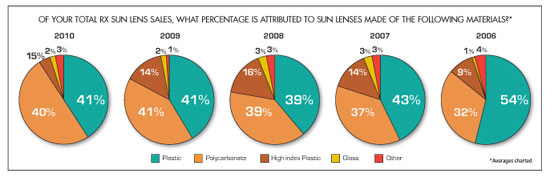

For example, premium lens materials are increasingly contributing significantly to the bottom line. Findings for the 2010 survey indicate polycarbonate and standard (CR39) plastic lenses account for nearly equal shares of Rx sun sales (polycarbonate comprises 40 percent of Rx sun lenses dispensed by survey participants and plastic, for 41 percent). High-index plastic represents an additional 15 percent. Five years ago, in 2006, standard plastic was the clear winner, accounting for 54 percent of Rx sun lens sales and polycarbonate, only 32 percent. With plano sunwear sales, too, polycarbonate lenses continue to make gains, comprising 42 percent of plano lenses dispensed in 2010, up from 35 percent in 2006.

Customized Rx sun lens programs also contribute positively to market share. Of those surveyed, 47 percent say they participate in prescription programs offered by name-brand sunwear/sport glasses companies. These programs duplicate proprietary performance-oriented features in prescription lenses.

The performance factor brings up another aspect that has been beneficial to the sun business. The past several years have witnessed a definite merging between fashion-oriented and sport-oriented sunglasses. Fashion sunglasses, although designed for street and urban wear, often are available with a variety of performance features including polarization and grippable, rubberized bridges and temple tips. And manufacturers are dressing up sport glasses with hot colors and contemporary shapes without sacrificing performance. In fact, half of the survey respondents feel the lines between fashion and sport sunwear are blurring; 57 percent believe this is helping the sales of Rx and plano sunglasses. Only 7 percent feel the merging is hurting their sunwear sales. Actually the blending of the two categories should be beneficial to both sunglass and sport glasses sales. Those individuals—frequently women reluctant to wear sport glasses because in the past they often seemed bulky and unattractive—now have many fashionable options available. Performance features, on the other hand, appeal to those who may not be athletes, but think of themselves as having an active lifestyle.

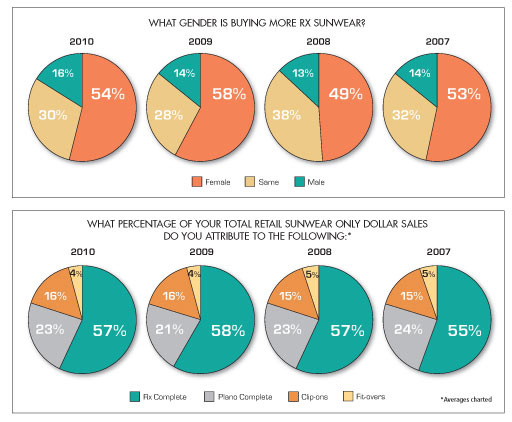

Still another factor pointing toward positive news for the sunglass business is, on the average, participants say Rx sunglasses accounted for the majority (57 percent) of total retail sunwear only dollar sales in 2010, significant because Rx product commands the highest price points in the sunwear category. Also those polled report 43 percent of their patients requested the plano sunwear they purchased be fitted with Rx sun lenses.

Additionally, although respondents say they dispensed clip-ons with only 14 percent of the Rx eyeglasses sold in 2010, representing 16 percent of retail sunwear dollars, clips-ons do contribute to the bottom line, selling for an average of $78.

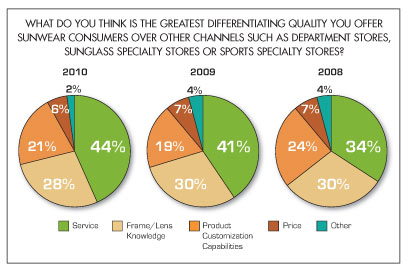

Further, on the plus side, survey participants seem well aware of the positive qualities differentiating them from other sunwear channels of distribution. Of the respondents, 44 percent cited superior service as the number-one attribute setting them apart from the competition; followed by frame and lens knowledge, indicated by 28 percent; and customization capabilities, 21 percent.

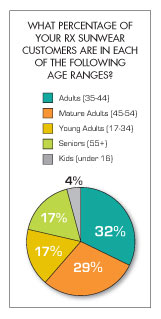

COOL PATCHES

Despite warming trends in the sun business, cool patches exist and aren’t necessarily the result of a weakened economy. ECPs need to continue reinforcing the fact that everyone needs sun protection every day of the year. According to those surveyed, the largest percentage of their Rx sunwear customers (32 percent) were adults between the ages of 35 and 44, followed by mature adults 45 to 54 (29 percent). Seniors (55 and older) and young adults (16 to 34) each represented 17 percent of the total. Children under 16 accounted for only 4 percent of all Rx sunwear customers.

As for the gender buying more Rx sunwear, women were cited as the winners by 54 percent of the respondents. Only 16 percent say men bought more sunwear and 30 percent report equal sun sales from both sexes.

In regard to selling sun year-round—although the sun knows no season—the majority of respondents characterize sunglass sales as high only during July and August (61 percent) and May and June (55 percent) and tumbling for the rest of the year with only 3 to 14 percent of respondents reporting high sun sales in the other months. Another area in which optical is falling far short of its potential is in dispensing sunglasses to contact-lens wearers. Just over half of the retailers surveyed (51 percent) claim they always recommend their contact-lens patients buy sunglasses and 5 percent never suggest sunwear to these customers. Even more disturbing, only 12 percent say their patients make a sunwear purchase at the time they are fitted for new contact lenses even though they will need sunglasses the moment they step outside.

Clearly optical has a rightful and respected place in the sun. The challenge—and the opportunity—are yours. But you need to be diligent in getting your message out there loud and clear: Everyone needs sun protection everyday, everywhere. Until this message is delivered 100 percent of the time to 100 percent of your patients, sunwear sales are not going to reach their full potential. ■

Methodology

Methodology

20/20 Magazine's 2010 Sunwear MarketPulse study is based on data collected from structured email interviews with 267 independent optical retailers. The samples were derived from the proprietary Jobson Database. All 2010 interviews were conducted in November 2010. Data is presented from a retailer's or practitioner’s perspective and may reflect seasonal market and thus behavioral fluctuations. All participants were contacted via email invitation and offered an incentive of a chance to win a $200 American Express gift card. This study was also conducted during the same time of year in 2006, 2007, 2008 and 2009. Trended data is charted wherever possible.

2009’s data was collected from structured interviews with 159 independent optical retailers, 2008’s data was collected from structured email interviews with 190 independent optical retailers and 2007's data was collected from structured email interviews with 180 independent optical retailers. All participants were contacted via email invitation and offered an incentive of a chance to win a $200 American Express gift card each year from 2007 to 2009. In 2006, 118 participants were contacted by phone by Jobson Research's in-house staff and completed the survey. No incentive was offered for participation in 2006.

—Jennifer Zupnick

Senior Research Analyst

Jobson Optical Research