Owners and operators of optical laboratories are meeting this challenge by investing in new systems that shorten turnaround time on orders and improve quality. They are also stepping up their sales, marketing and education programs in order to give their customers the tools they need to effectively dispense eyewear to consumers who are increasingly discriminating and demanding about what they buy and from whom they buy it. 20/20’s annual Wholesale Lab Usage Survey provides insights into the types of products and services ECPs are buying from labs and what they are basing their purchasing decisions on. The following topline data and charts offer useful information that can serve as a benchmark for gauging how your practice utilizes the many products and services offered by their lab (or labs, in some cases).

–Andrew Karp

TOPLINE ANALYSIS

- Forty-four percent of the independent eyecare professionals surveyed expect to do more business with wholesale labs in the coming year.

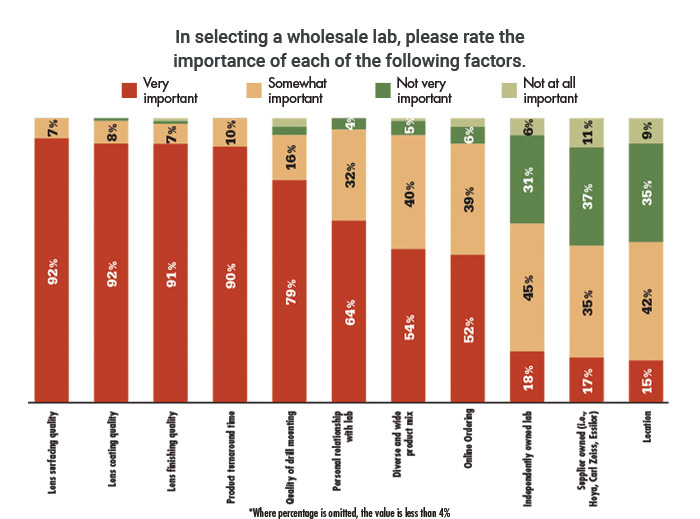

- The factors that were rated “very important” in selecting a wholesale lab are based on the quality of services more so than the characteristics of the labs themselves (e.g., ownership).

- The factors in selecting a lab considered veryimportant by most are lens surfacing quality (92 percent), lens coating quality (92 percent) and lens finishing quality (91 percent).

- The majority of locations purchase surfaced lenses (92 percent) and safety glasses (71 percent) from their primary lab.

- The services provided most often by the respondent’s primary lab were lens product information (98 percent), technical support (98 percent) and online ordering (96 percent).

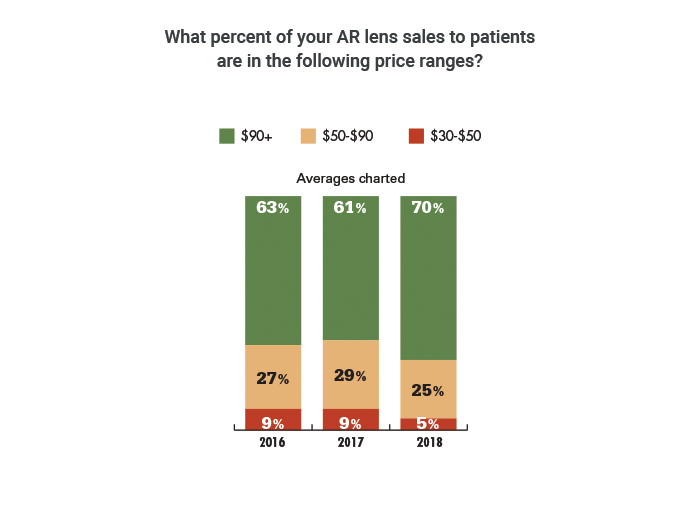

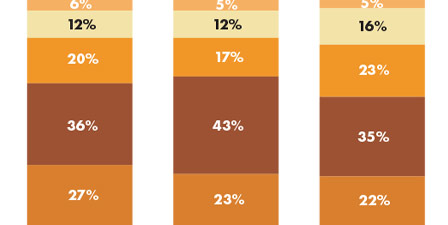

- Seventy percent of AR lens sales were more than $90, compared with 61 percent in 2017 and 63 percent in 2016.

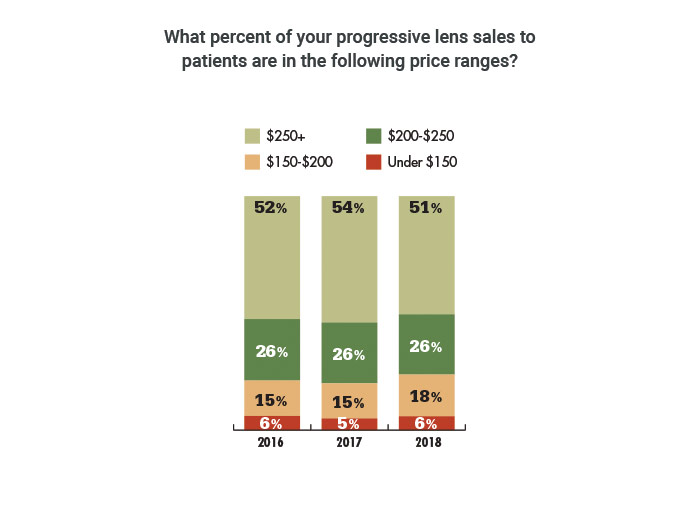

- Respondents said that 18 percent of the progressive lenses they sold in 2018 were between $150 to $200, up from 15 percent in 2017 and 15 percent in 2016

METHODOLOGY

20/20’s Wholesale Lab Usage Survey 2018 was conducted during June 2018 by Jobson Optical Research’s in-house research staff. The sample of 316 respondents was derived from the proprietary Jobson Optical Research Database.

The 2018 survey was conducted online, and only eyecare professionals at independent locations (one, two or three affiliated practices) who use a wholesale lab for processing lenses or providing other eyewear products and services were qualified to complete the survey. Respondents to the survey were entered in a sweepstakes to win a $200 amazon.com gift card.

Three years of data is shown for trending purposes. The 2016 survey was conducted online in June 2016. 182 respondents at optical retail locations completed the survey and were offered a chance to win a $200 American Express gift card as an incentive. The 2017 survey was conducted online in June 2017. 265 respondents at optical retail locations completed the survey and were offered a chance to win a $200 American Express gift card as an incentive.

–Jennifer Waller

Jobson Optical Research