Photographed by Ned Matura

BLACKFIN Kami 928 from Villa Eyewear

With last year’s unexpected challenges, sunwear sales experienced a slower growth compared to previous years. But there’s no question sunwear remains a popular and necessary accessory among consumers. 20/20 presents our annual Sunwear MarketPulse Survey 2021 conducted by Jobson Research, surveying 226 independent optical retailers on their sunwear sales performance and emerging market trends. As we return to a near normal, we’re looking forward to a sunny forecast for sunwear’s performance.

– Jennifer Waller

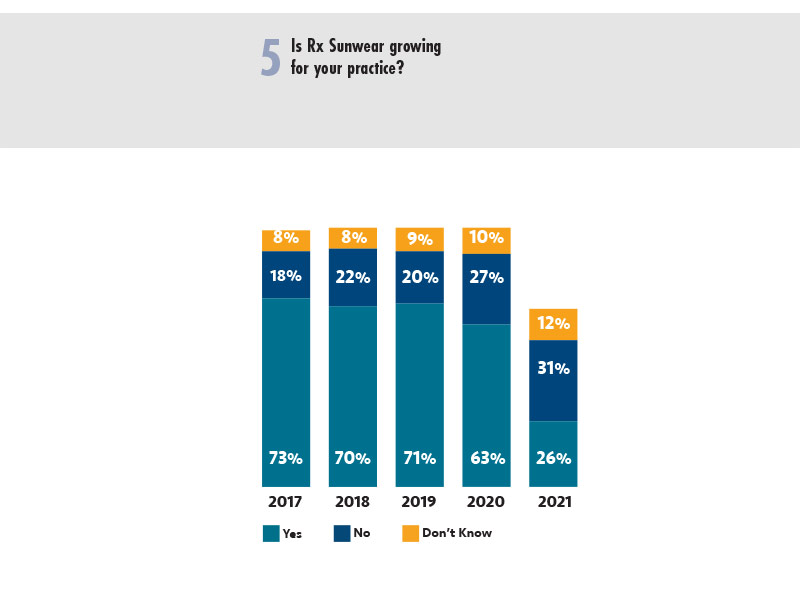

- Twenty-six percent of respondents said that Rx sunwear is growing for their practice. This is a significant dip from prior years and likely due to the COVID-19 pandemic.

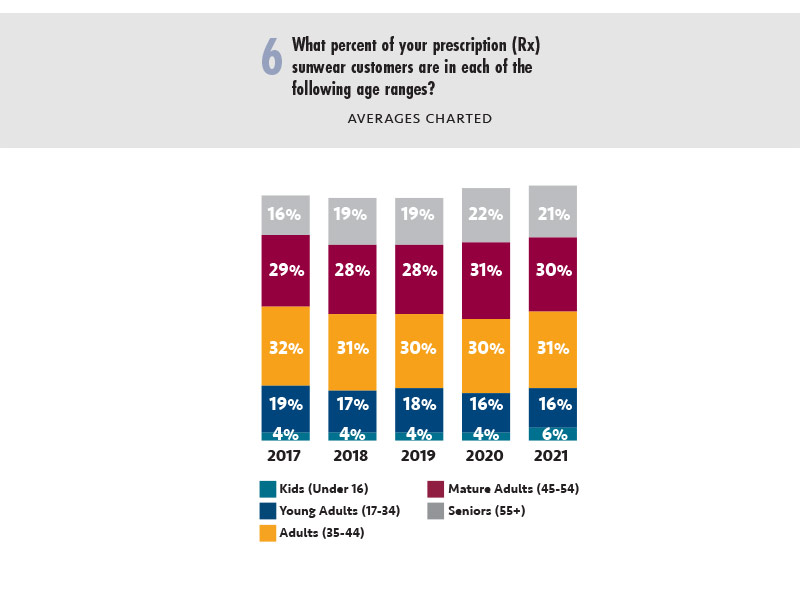

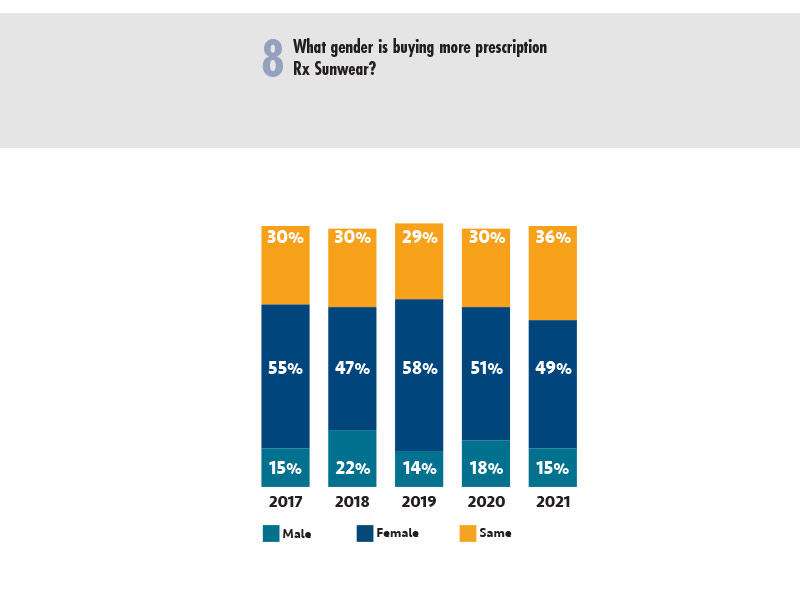

- Adults (age 35-44) and mature adults (age 45-54) accounted for the largest percentage of Rx sunwear sales (an average of 31 percent and 30 percent, respectively), according to those independents surveyed. Almost half (49 percent) of respondents said that females are buying more Rx sunwear than males. Fifteen percent said males more than females, and 36 percent said the same for both genders.

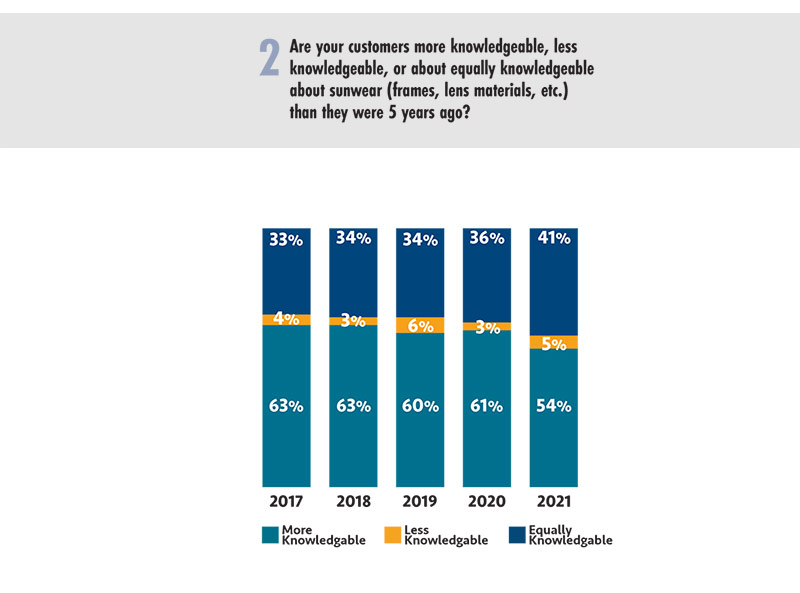

- Of the independents surveyed, 54 percent said consumers are more knowledgeable about sunwear than they were five years ago.

- Forty-seven percent disagreed with the statement that they feel the lines between fashion-oriented sunwear and sports-oriented sunwear are blurring compared to 43 percent agreeing (8 percent said don’t know). Of the 43 percent that agreed the lines were blurring, 39 percent think this is helping the sales of both Rx and plano sunglasses. Only 7 percent claim the merging is hurting their sunwear sales.

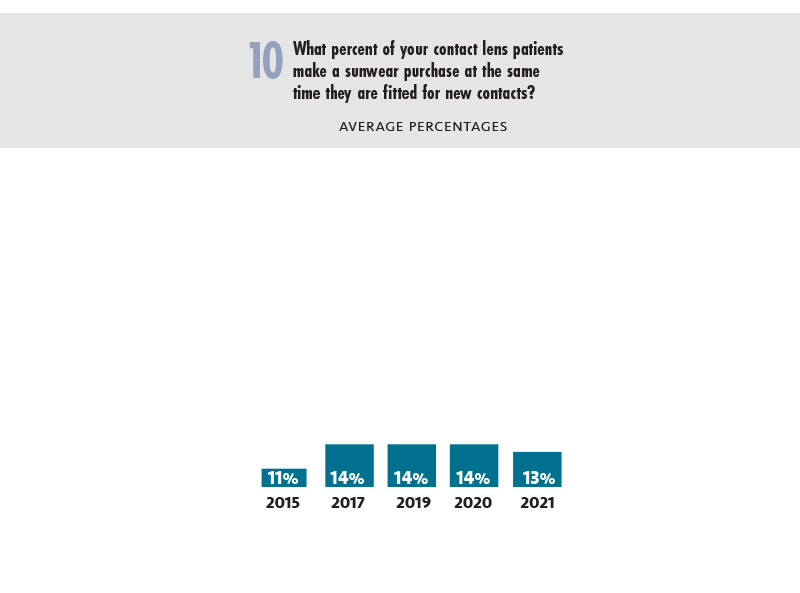

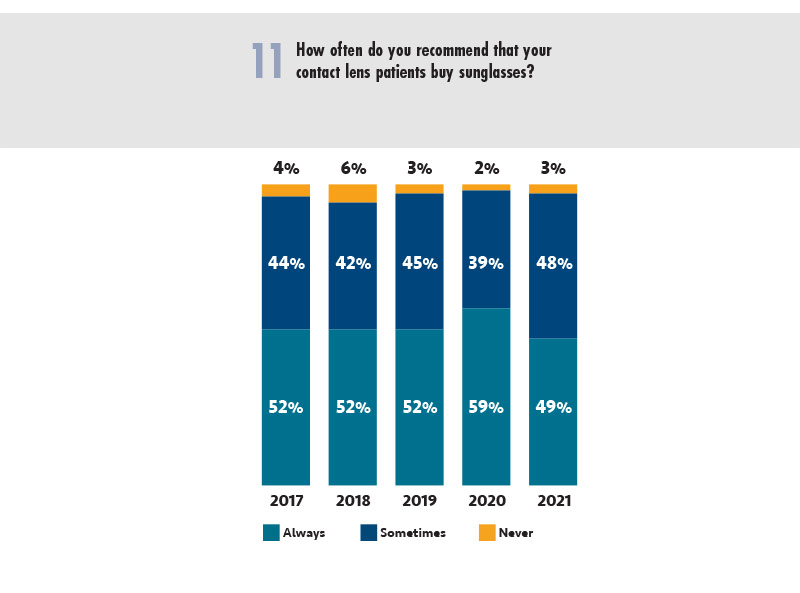

- Half (49 percent) of independents surveyed said they always recommend that their contact lens patients buy sunglasses. However, respondents said only 13 percent of their patients on average actually make a sunwear purchase at the time they are fit for new contacts.

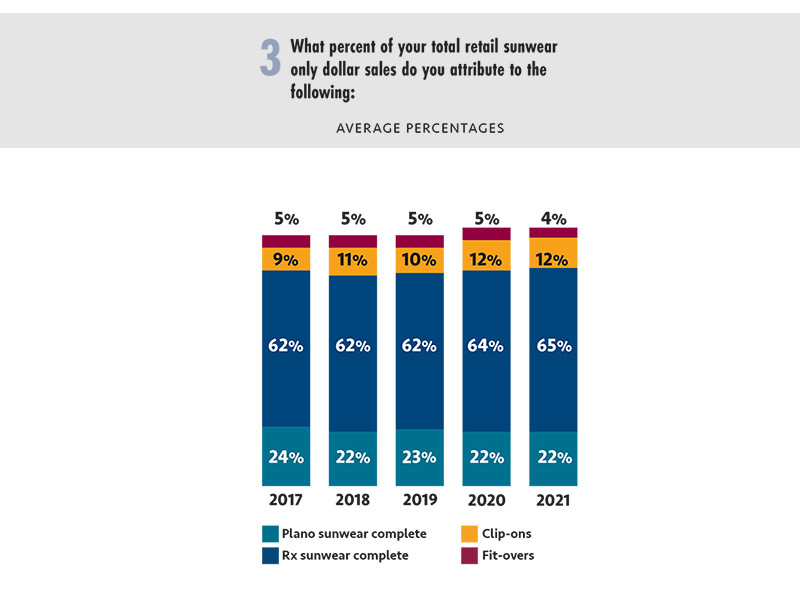

- On average, respondents said 65 percent of total retail sunwear comes from Rx complete, 23 percent from plano complete, 12 percent from clip-ons and 5 percent from fit-overs.

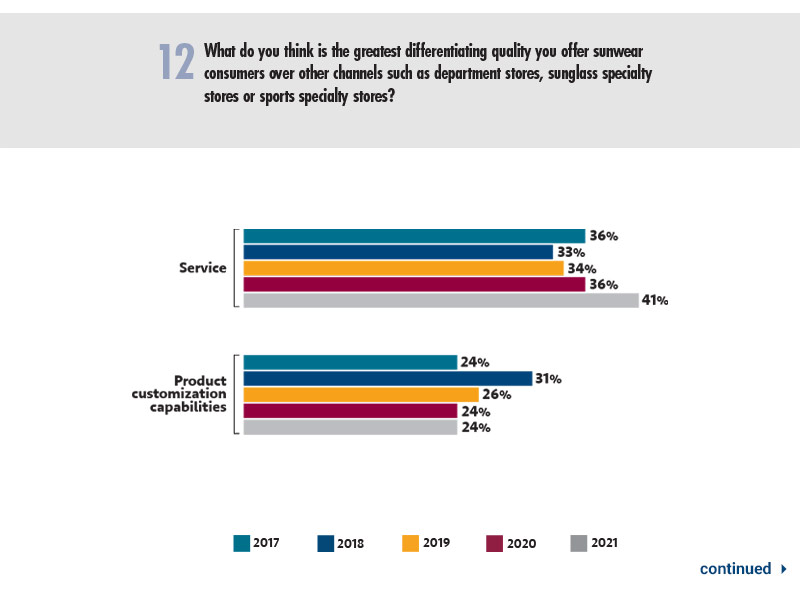

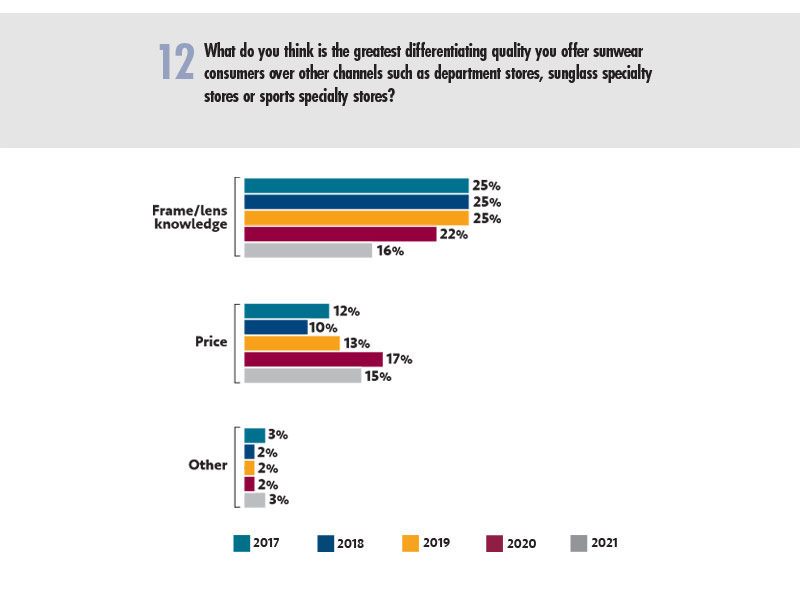

- When asked what the greatest differentiating quality independents have over other channels was, superior service takes the top spot with 41 percent, followed by product customization at 24 percent and frames/lens knowledge at 24 percent.

- On average, independents said polycarbonate lenses made up 47 percent of their total prescription sun lens sales, as well as 47 percent of plano sunwear lens sales. Plastic/high-index plastic lenses made up 48 percent of total prescription sun lens sales and 50 percent of plano sunwear lens sales.

- Not surprisingly, July/August was rated the highest sunglass sales period for 61 percent of independents. May/June followed with 57 percent rating it as a “high” period for sunglass sales. For comparison, January/February came in only at 5 percent rating it high.

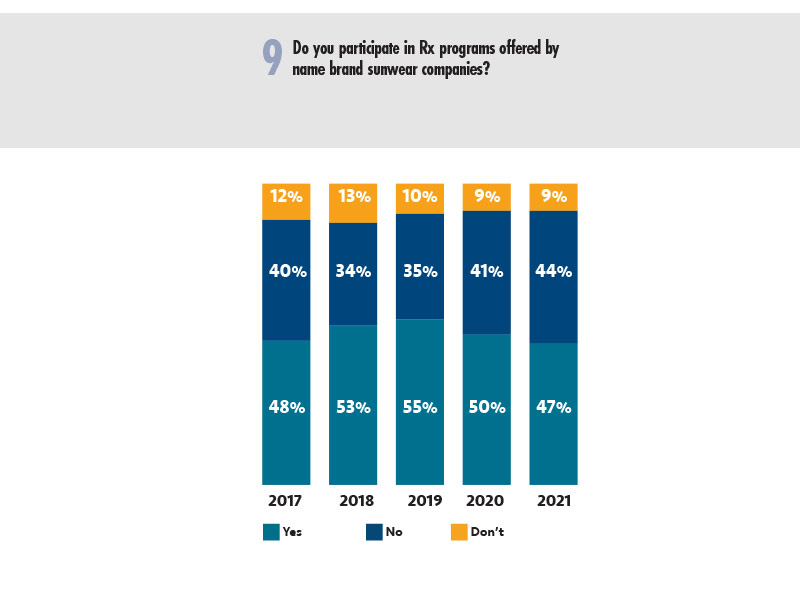

- Close to half of independents say they participate in Rx programs offered by sunwear companies (47 percent). Nine percent were unsure.

METHODOLOGY

20/20’s Sunwear MarketPulse Survey 2021 is based on data collected from structured e-mail interviews with 226 independent optical retailers. The samples were derived from the proprietary Jobson Database. All 2021 interviews were conducted in March 2021. This study is conducted annually. Trended data is charted wherever possible. All participants were contacted via e-mail invitation and offered an incentive of a chance to win a $200 amazon.com gift card. For more information, contact [email protected] or (212) 274-7164.