Faced with heightened expectations from customers, both wholesale and retail labs are upgrading their operations and improving their performance in order to remain competitive.

In L&T ’s 2007 Lab Usage Survey, we polled 240 independent vision care professionals and optical retailers to find out their perceptions and attitudes about their labs as well as the essential products and services the labs supply to them. We compared their responses with those of respondents from the previous two Lab Usage Surveys. Here’s what we learned.

—Andrew Karp

Topline Analysis

• Most locations use a wholesale lab for processing lenses or providing other eyewear products and services.

• About 7 out of 10 (72.5 percent) locations work with more than one wholesale lab.

• 52.1 percent expect to do more business with wholesale labs in the coming year. Only 4.6 percent expect to do less.

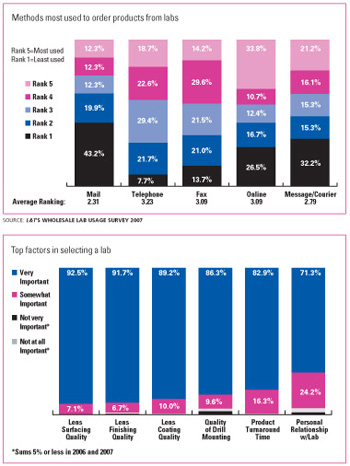

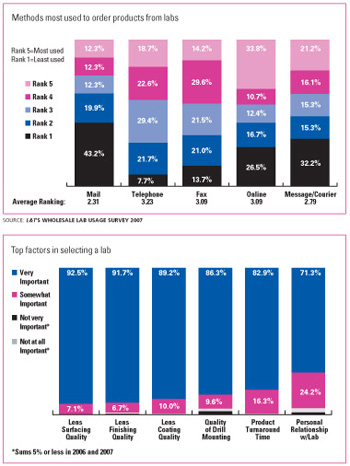

• The most important factors in selecting a lab are lens surfacing quality (92.5 percent), lens finishing quality (91.7 percent), lens coating quality (89.2 percent), quality of drill mounting (86.3 percent) and product turn around time (82.9 percent).

• The majority of locations purchase spectacle lenses (92.9 percent), surfaced lenses (72.9 percent) and safety glasses (58.3 percent) from their primary lab.

• Most labs that sell spectacle lenses offer online ordering; however, 61.9 percent of respondents have never sent in frame tracing data with an online order.

• Although only 38.1 percent of respondents have ever sent in frame tracing data with an online order, this number is up from previous years.

• About 7 out of 10 locations are familiar with the lens technology term “freeform.” Of those who are aware of this lens technology, 54.3 percent currently dispense lenses manufactured by freeform methods.

• 3/4 of the locations are familiar with the lens technology term “digital surfacing.” Of those who are aware of this lens technology, 51.1 percent currently dispense progressive lenses manufactured by digital surfacing lenses.

• Half of the locations have lens edging capability in-house. Among these locations, an average of 64.6 percent of all edged jobs are done in-house.

Methodology

The L&T Wholesale Lab Usage Survey 2007 was conducted during the September 10 to September 11, 2007 time period by Jobson Optical Research’s in-house research staff. The sample of 240 optical retailers was derived from the proprietary Jobson Optical Research Database.

The 2007 survey was conducted via the Internet and respondents who completed the survey were entered in a sweepstakes to win a $500 American Express gift card.

Three years of data is shown for trending purposes. The 2005 survey was conducted via telephone. 213 respondents at independent optical retail locations were asked a series of structured questions and no incentive was offered. The 2006 survey was conducted via the Internet. 215 respondents at independent optical retail locations were asked a series of structured questions and an incentive of a chance to win a $200 American Express gift card was offered.

• Most locations use a wholesale lab for processing lenses or providing other eyewear products and services.

• About 7 out of 10 (72.5 percent) locations work with more than one wholesale lab.

• 52.1 percent expect to do more business with wholesale labs in the coming year. Only 4.6 percent expect to do less.

• The most important factors in selecting a lab are lens surfacing quality (92.5 percent), lens finishing quality (91.7 percent), lens coating quality (89.2 percent), quality of drill mounting (86.3 percent) and product turn around time (82.9 percent).

• The majority of locations purchase spectacle lenses (92.9 percent), surfaced lenses (72.9 percent) and safety glasses (58.3 percent) from their primary lab.

• Most labs that sell spectacle lenses offer online ordering; however, 61.9 percent of respondents have never sent in frame tracing data with an online order.

• Although only 38.1 percent of respondents have ever sent in frame tracing data with an online order, this number is up from previous years.

• About 7 out of 10 locations are familiar with the lens technology term “freeform.” Of those who are aware of this lens technology, 54.3 percent currently dispense lenses manufactured by freeform methods.

• 3/4 of the locations are familiar with the lens technology term “digital surfacing.” Of those who are aware of this lens technology, 51.1 percent currently dispense progressive lenses manufactured by digital surfacing lenses.

• Half of the locations have lens edging capability in-house. Among these locations, an average of 64.6 percent of all edged jobs are done in-house.

Methodology

The L&T Wholesale Lab Usage Survey 2007 was conducted during the September 10 to September 11, 2007 time period by Jobson Optical Research’s in-house research staff. The sample of 240 optical retailers was derived from the proprietary Jobson Optical Research Database.

The 2007 survey was conducted via the Internet and respondents who completed the survey were entered in a sweepstakes to win a $500 American Express gift card.

Three years of data is shown for trending purposes. The 2005 survey was conducted via telephone. 213 respondents at independent optical retail locations were asked a series of structured questions and no incentive was offered. The 2006 survey was conducted via the Internet. 215 respondents at independent optical retail locations were asked a series of structured questions and an incentive of a chance to win a $200 American Express gift card was offered.

—Jennifer Zupnick and Beth Briggs, Jobson Optical Research