Eyewear images, from top left,

clockwise: Cynthia Rowley, Miu Miu, Stetson, DKNY, Invincilites,

Thalia,

and Ray-Ban

Ophthalmic.

By Marge Axelrad

Editorial Director

NEW YORK--From the heights of luxury and high-end design to the plateau of “value’ frames and low-priced promotional packages for frames and lenses, today’s eyewear consumers face a dizzying array of choice for ophthalmic frames in today’s market.

But what is the segment of the business that reflects exactly where the majority of these customers finally make that choice?

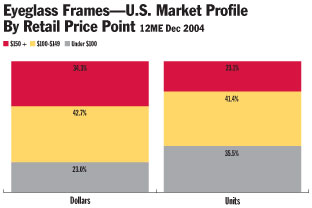

By far, the largest proportion of frames in the U.S., some 41.4 percent of all units purchased, representing 42.7 percent of dollars, are sold between the key retail price points of $100 to $149.

This “middle” or “moderate” priced segment remains the “sweet spot” of the market and how optical retailers and dispensers handle their buying, presentation and sell-through of this important range is a key influencer of profits and positioning in today’s market.

A total of 64 million eyeglass frames

are sold annually across all types of optical retailers, large and

small (Jobson/VCA/ VisionWatch’s year-end 2004

estimate).

A total of 64 million eyeglass frames

are sold annually across all types of optical retailers, large and

small (Jobson/VCA/ VisionWatch’s year-end 2004

estimate).

Some 35.5 percent of all frames are sold at prices of $100 and below. Only 23.1 percent of all frame units sold across all types of retailers are sold at prices of $150 and higher.

Is this a factor of what type of retail outlet is involved and how a retailer is positioned to the consumer? Sure.

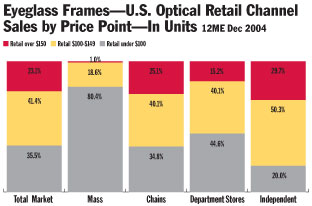

Among different types of optical retailers, the mix can and does vary. Mass merchants, for instance, move the vast majority of frames at $100 or less. And independent optical retailers sell the smallest proportion of units at that price point, roughly 20 percent of their frame mix, on average across the country.

But for independent retailers in particular, who tend to sell some 30 percent of their frame mix, on average, at the upper-moderate or high-end level--retail prices over $150--the moderate segment of $100 to $149 represents the vast majority of the frames they sell, some 50 percent of all units.

How ECPs manage that segment of their frame mix, and how they present frames at that level to the customers they serve, can play a critical role in the profitability of the dispensary and the positioning of their dispensary to consumers in their market.

In some cases, the moderate segment is seen as a platform, a “core” of a dispensary’s day-to-day business, as frame buyers try to address the needs of those consumers’ intrigued by high-end designer or luxury brands and images but concerned about price points that start at $200 and move up from there.

In some cases, this moderate segment is a step up from “value” and provides consumers a comfortable place to stay fashion-right, access quality frame technology or details.

In both cases, the $100 to $149

segment has become the “bread and butter” of

today’s ophthalmic frame marketplace.

In both cases, the $100 to $149

segment has become the “bread and butter” of

today’s ophthalmic frame marketplace.

The market overall is selling less frame units in total than it was 10 years ago. Perhaps that’s because spectacle lenses, with new treatments and technologies, are comprising ‘more’ of the eyeglass sale. Or perhaps it’s because the frames consumers bought the last time they bought glasses are lasting longer or because consumers perceive there is not enough ‘newness’ in frame styles to merit changing their frame.

In fact, market observers say, it might be all of these things.

The moderate price point however is host to a range of frame brands, addressing the fashion mainstream, with styling features and components and color, that are enlivening this vast middle of the market.

As Christopher Shyer, president of Zyloware, points out, “People are supporting their businesses through fewer units overall and with higher dollar sales in lenses and add-ons. That still creates pressure. When it comes to this important $100 to $150 price category, the retailer has to not lose sight of the fact that this category can help solidify their positioning with their customers. This is the range that can be a contrast to ‘value’ frames. It represents a step up in quality, frame features and technology and often a brand name that helps this customer feel positive about their frame choice.”

Zyloware brands like Sophia Loren and Stetson, the new Invincilites and the starting platform of the new John Deere range are targeting this arena. “Consumers who may initially be attracted to a no-name frame for under $100 can be informed by dispensers about the technology or quality components or style details of a frame and will spend an additional $25 or $50 to get those things and still feel good about trading up that purchase. Many retailers sustain their reputation for quality by pointing out the aspects of frames at the key $100 to $150 price point.”

“At this price point,” adds David Duralde, vice president of creative direction for Kenmark Group, “there’s the greatest cluster of buying power. This customer becomes more discerning. There’s a general trend among consumers today, at all sectors of the market, to buy ‘up’ and to feel confident in that decision. They want their purchase to be meaningful and are more careful but will spend more money if there’s value for them. There are style trends out there that transcend price. And in this category, a dispenser can talk about quality, features, benefits and the message of a brand that can help the customer feel good about their frame choice in this price point.”

At Kenmark, brands like Thalia, Cynthia Rowley and Hush Puppies, are examples, Duralde says, of those ranges that address consumers’ growing interest in styling or color or fashion details within this price domain. “This category has a lot of bang for brands, which reinforce that something is a higher value to that consumer. A consumer looking at frames in the $100, $120 and $140 range is moving up a step and is receptive to learning about what they can get at that level. Customers today are not afraid to buy, they’re concerned about making a bad purchase,” Duralde said.

“Fashion is changing quickly today, the pace is faster,” noted Jean Scott, vice president, Luxottica. “The $100 to $150 price point is part of that bell curve, which is different for everyone but is an important touch point for all. It can be your top or bottom but its key for everyone today; there is fashion, quality, branding in this segment, more than perhaps ever before.”

At Luxottica, said Scott, “We’re focusing a lot on this segment, from Ray-Ban ophthalmic to bridge designers like Versus or Miu Miu or DKNY or solid style/feature moderate values like Vittadini or Brooks Brothers. “

She added, “Savvy buyers will make a point to learn what’s happening at higher price points and in designer ranges and learn how they can point out what’s translating to customers at this $100 to $150 price point. It’s a solid sector of the market that helps their customers and helps build their practice.”