|

| KEN LEE/BLACK BOX STUDIO

Laps courtesy of Optical Works Corp. Pads courtesy of DAC Vision |

By Andrew Karp

Group Editor, Lenses and Technology

NEW YORK--When the first wave of consolidation rocked the optical lab sector a decade ago, many independent wholesalers drew battle lines between themselves and the newly emerged supplier-owned lab networks. These proud independents resented the vertical integration by some of their key lens suppliers as a direct competitive threat.

Although tensions have since cooled, supplier-owned labs and independently-owned labs remain competitors. They distinguish themselves by their mix of branded products, the range of services they offer, and how they position themselves to their customers as well as in relationship to each other.

Yet these two groups of optical wholesalers also share many commonalities, and they are growing more similar every year. The largest U.S. labs are aggressively pursuing new technologies that will enable them to offer the highest value products as well as adopting new strategies for aligning themselves with key suppliers who can deliver those products.

VM’s new 2007 Top Lab survey, an annual report that ranks the Top 25 Independent U.S. Wholesale Labs and the Top 5 U.S. Supplier-Owned U.S. Wholesale Lab Networks, offers fresh statistical evidence that the industry’s biggest labs have much in common. One of the report’s key findings, for example, is that each of the Top 5 Supplier-Owned Lab Networks and each of five leading Independents increased its Rx sales in 2007. Additionally, each of the Top 5 Supplier-Owned Lab Networks labs increased the number of Rx jobs per day it produced versus last year; three of the Top 5 independent labs also produced more Rx jobs per day than in 2006. Although some of the Top 5 Supplier-Owned Lab Networks grew as a result of mergers and acquisitions--most notably Essilor Laboratories of America--financial results from these companies indicate that strong sales of high-value products such as progressive lenses, photochromic lenses and anti-reflective lenses were the primary growth factors in 2007. Similarly, all of the Top 25 independent labs grew as a result of sales increases for these types of lenses.

This trend is expected to intensify in 2008, as more labs, both supplier-owned and independent, acquire direct surfacing technology. The technology allows labs to produce sophisticated progressives and other lens designs as well as improve efficiencies in production and inventory management. However, the high cost of the technology will limit its use to labs that are well-capitalized.

Despite competition between supplier-owned labs and independents, there remains a great deal of mutual interdependence. Independent labs still represent an essential link in the wholesale distribution chain for the major lens suppliers, all of which operate their own lab networks. Similarly, independents count on these same suppliers for a significant proportion of the products they sell, although allegiances to suppliers are always subject to shifts in the competitive climate.

Top 5 Supplier-Owned Networks

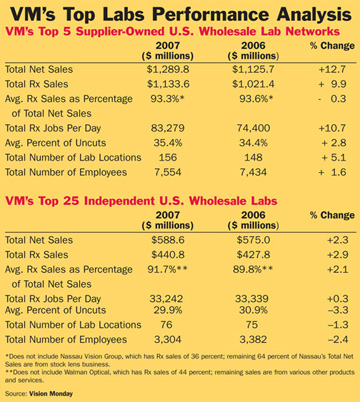

2007 was a strong year for the Top 5 Supplier-Owned Wholesale Lab Networks. These labs are expected to generate total net sales of $1,289.8 million, up 12.7 percent over 2006. Total Rx sales, which is based on the labs’ core business of surfacing and finishing prescription lenses and is the basis of the primary ranking of the Top Labs, amounted to $1,133.6 million, or 93.6 percent of total net sales on average. This represents a 9.9 percent increase over 2006.

Both Hoya Vision Care and Carl Zeiss Vision had significant growth in Rx sales in 2007, with 19.1 percent and 21.5 percent increases, respectively. Zeiss also increased its productivity significantly, with a 30 percent rise in Rx jobs per day over 2006.

The number of Rx jobs for the Top 5, in aggregate, totaled 83,279, up 10.7 percent over 2006. On an annualized basis, this amounts to a total of about 20.8 million Rx jobs, up from 18.6 million last year. The average proportion of uncut lens jobs among the Top 5 was 35.4 percent compared with 34.4 percent last year, a 2.8 percent rise.

As a result of acquisitions, the Top 5 added 25 individual lab locations in the past 12 months, bringing the total number to 156, compared with 148 in 2005. The Top 5 work force consists of 7,554 employees in 2007 compared with 7,434 employees in 2006, a 1.6 percent increase.

As in recent years, a sizable portion of the Top 5’s growth was a result of acquisitions made by the three largest Supplier-Owned labs networks. Two labs that ranked among VM’s Top 25 Independent Wholesale Labs in 2006--Sutherlin Optical, based in Kansas City, Mo., and Beitler McKee Optical, based in Pittsburgh, Pa.--were acquired by supplier-owned lab networks in the past 12 months.

The Top 25 Independents

The Top 25 Independents

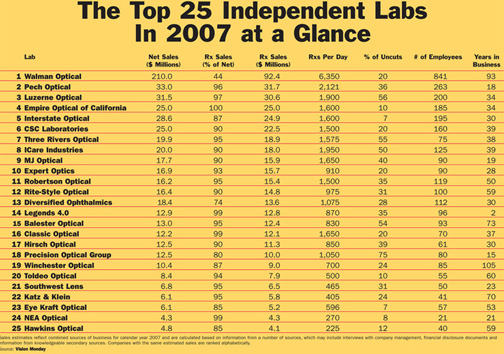

Collectively, the leading independent wholesalers experienced modest growth in 2007. The total aggregate net sales for the Top 25 Independents was $588.6, a 2.3 percent from 2006. Total Rx sales for the Top 25 reached $440.8 million, or 91.7 percent of total net sales on average. This represents a 2.9 percent increase over 2006. The growth is almost entirely organic, and not the result of mergers or acquisitions.

In general, the larger independent labs experienced the highest growth rates among the Top 25. For example, the Top 5 independents grew their Rx sales by an average of 12.8 percent over last year.

Unit sales among the Top 25 were flat in 2007. The independent labs produced a total of 33,242 Rx jobs per day, which amounts to approximately 8.3 million Rx jobs per year, a 0.3 percent decrease from 2006. On average, uncut lenses accounted for 29.9 percent of Rx jobs produced by the Top 25, down 3.3 percent from 2006.

Collectively, the Top 25 operate 76 individual lab locations, one more than in 2006. The Top 25 labor force consists of 3,304 employees, down 2.4 percent from 2006.

Technology transfers from suppliers to independent labs continue to boost revenues for a growing number of independents. This year, for example, Robertson Optical of Columbia, S.C. became the latest independent wholesaler to install a Zeiss anti-reflective coating facility, enabling the lab to produce Teflon and other premium Zeiss coatings on-site.

Other Top 25 independents are acquiring direct surfacing technology. In 2006, Rite-Style became the first independent lab to make the leap into direct surfacing. This year, Pech Optical followed suit, and Expert Optics is expected to be next.

The spread between the largest and smallest of the Top 25 continued to grow. This year, the Top 25 independents ranged from $92.4 million in Rx sales for Walman Optical, the number one-ranked independent lab down to $4.1 million for Hawkins Optical, the 25th ranked lab.

Two independent labs entered the Top 25 for the first time this year: Katz & Klein, a 70-year-old wholesaler in Sacramento, Calif., and NEA Optical, a 21-year-old lab in Jonesboro, Ark.

Top 10 U.S. Wholesale Labs

The Top 10 U.S. Wholesale Laboratories generated $1,584.9 million in total net sales in 2007, up from $1,435.3 million in 2006. Rx sales for this group, which consists of the largest independent and supplier-owned labs, totaled $1,338.2 million, up from $1,213.4 million in 2006.

The Top 10 collectively produced 97,300 88,238 Rx jobs per day, which amounts to about 24.3 million Rx jobs per year, compared with 88,238 Rx jobs per day in 2006.