Normally when we think of design, it tends to be about the externals—the store’s overall decor and display. All this is important because if a practice looks dull or dreary, it can take away from its great care, service and good product mix. Like always, we examine all this in 20/20’s exclusive Retail Design Survey.

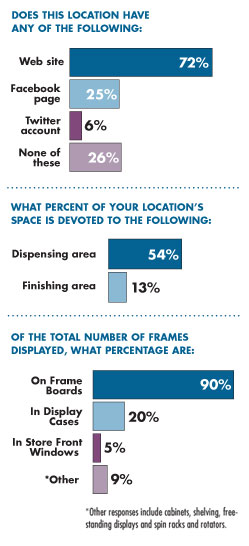

And this time 20/20 also decided to see what dispensers were doing virtually, whether or not eyecare professionals had embraced the web as a way to showcase their practice before a patient walks through the door. Many of the so-called experts out there have told 20/20 the Os are late to the game when it comes to the Internet. Our results, however, found the contrary: 72 percent of practices have a web site and 25 percent have a Facebook page. That’s great news because all of this—both the virtual and the bricks-and-mortar—combines to be the face of the dispensary.

With that said, we present the results of 20/20’s 2010 Retail Design Survey.

STAYING ON POINT

The point of display is a vital tool to showcase brands carried and services offered, as well as to create an interest in featured styles. For example, if a dispensary is in a resort area, having a sun or sport eyewear display with strong point-of-purchase items can turner a browser into a buyer. The majority of practices, 87 percent, rely on vendor-supplied POP. That’s fine as many manufacturers go out of their way to create strong display materials to complement their products. But practices also like to put their own distinct stamp on their displays; 51 percent of retailers said they take that extra step, creating their own merchandising materials.

The point of display is a vital tool to showcase brands carried and services offered, as well as to create an interest in featured styles. For example, if a dispensary is in a resort area, having a sun or sport eyewear display with strong point-of-purchase items can turner a browser into a buyer. The majority of practices, 87 percent, rely on vendor-supplied POP. That’s fine as many manufacturers go out of their way to create strong display materials to complement their products. But practices also like to put their own distinct stamp on their displays; 51 percent of retailers said they take that extra step, creating their own merchandising materials.

Dispensers do perceive there is value to display materials as 54 percent said they find the items “somewhat useful” and 40 percent found them “very useful.” Only 6 percent found them “not useful.”

The most popular POP materials continue to be brochures (cited by 86 percent of respondents) and countercards (cited by 83 percent), followed by demonstration kits at 63 percent and spin racks at 40 percent. Premium items such as perfume, jewelry, toys and other accessories, account for 18 percent of POP. DVDs and videos were cited by 21 percent of respondents.

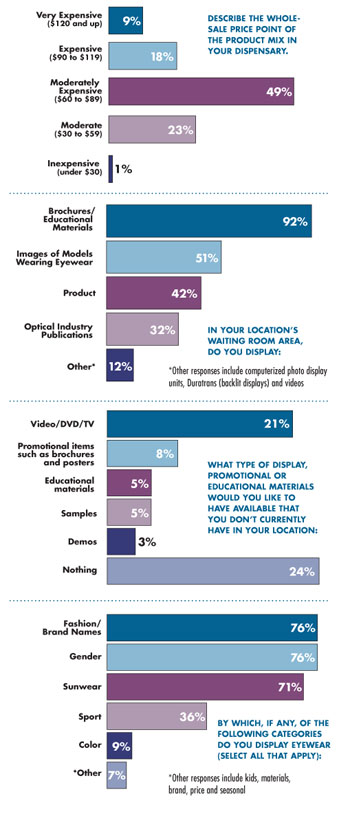

Speaking of video, when asked what kinds of promotional or educational materials they would like, video/DVDs/TV was the number-one item listed by dispensers at 21 percent. That was far more than the next highest item, brochures and posters, cited by 8 percent. This may be because more than a quarter of the respondents (30 percent) have some sort of video in the waiting room, most likely thanks to the advent of easy-to-display flat screen TVs. It pays to sell to a captive audience.

BEYOND THE FRAME

Lenses are a critical part of the eyewear package, however, only 12 percent of display space is dedicated specifically to spectacle lenses, lens treatments or lens-related educational information, which is the same as last year. Interesting to note, 54 percent of practice space is devoted to the dispensing area while 13 percent is dedicated to the finishing area.

Sunglasses and contact lenses get a space of their own. A separate area devoted to sunwear and sun lens products was a part of 81 percent of practices surveyed while a separate area for contact lens fitting was cited by 84 percent of respondents.

STILL ON BOARD

STILL ON BOARD

The frame board seems here to stay. The “board” continues to be used as the main means of display by the vast majority of dispensers—a whopping 90 percent. This is most likely because retailers do not go by the adage “less is more.” They tend to have a large amount of frame units—47 percent have 500 to 1,000 frames in their inventory while 21 percent have more than 1,000, according to the survey.

Aside from frame boards, display cases were a distant second at 20 percent and store-front windows were an even more distant third at only 5 percent. “Other” items, including cabinets, shelving, free-standing displays and spin racks and rotators, accounted for 9 percent of the means in which respondents displayed frames. This board dependence is easily the greatest difference optical has in comparison to other retail merchandising.

Gender along with fashion/name brands were both cited by 76 percent as the top categories in which dispensers display eyewear, followed closely by sunwear at 71 percent. Sport was cited by 36 percent and color by 9 percent. “Other” categories, such as kids, materials, brand, price and seasonal, was cited by 7 percent.

WAITED ON

As mentioned, the waiting room is a good area to promote your products and services to a captive audience, which is probably why 64 percent of respondents said they have their waiting area incorporated into their dispensary area.

Product brochures and education materials are the number-one items displayed in the waiting room (92 percent), followed by posters and countercards (51 percent), product (42 percent), industry publications—like 20/20—(32 percent) and “other” items such as computerized photo display units, Duratrans (backlit displays) and videos were cited by 12 percent.

JUST KIDDING

Kids continue to be a vital part of the optical dispensary. Of the retailers who sell to kids ages two to 14, 74 percent have a separate area devoted to children. Respondents recognized their youngest patients are important so most make sure to create a kid-friendly environment.

The kids’ section in the dispensaries surveyed include items to keep young patients occupied and feeling comfortable: books (48 percent), toys (45 percent), child-size furniture and a play area (both 30 percent) and DVDs and videos (8 percent). Other items cited by 29 percent of retailers included TVs, aquariums and mirrors.

THE PRICE IS RIGHT

The economy is showing signs of slowly recovering, but whether times are good or bad, price points are always a factor for both dispensers and their patients. When asked to describe the wholesale price point of the products they offer, 49 percent fell into the “moderately expensive” category, $60 to $89, according to the survey. It’s interesting to note that while “moderate,” priced $30 to $59, was second at 23 percent, “expensive” ($90 to $119) was a close third at 18 percent. “Very expensive” ($120 and up) was next at 9 percent, while only 1 percent responded their product fell into the “inexpensive” (under $30) range.

Whether online or off, it’s important for ECPs to make sure their dispensary reflects the high quality of care given to their patients. Looks do count when it comes to staying ahead of all retail competitors, optical or not.

METHODOLOGY

20/20’s Retail Design Survey 2010 was conducted from May 27, 2010 to June 1, 2010 by Jobson Optical Research’s in-house research staff. The sample of 220 independent optical retailers was derived from the proprietary Jobson Optical Research Database. Jobson considers independents any retailer with one, two or three locations. The study was conducted via the Internet and a chance to win a $200 American Express gift card was offered as an incentive.

To ensure consistency in results, all surveys were conducted during the same May/June time period. The 2007, 2008 and 2009 studies were conducted via the Internet and a chance to win a $300 American Express gift card was offered as an incentive in 2007 and a $200 American Express gift card was offered as an incentive for 2008 and 2009. Where available, four-year comparisons of survey results are provided. The analysis represents historical data and might reflect seasonal market fluctuations.

20/20’s Retail Design Survey 2010 was conducted from May 27, 2010 to June 1, 2010 by Jobson Optical Research’s in-house research staff. The sample of 220 independent optical retailers was derived from the proprietary Jobson Optical Research Database. Jobson considers independents any retailer with one, two or three locations. The study was conducted via the Internet and a chance to win a $200 American Express gift card was offered as an incentive.

To ensure consistency in results, all surveys were conducted during the same May/June time period. The 2007, 2008 and 2009 studies were conducted via the Internet and a chance to win a $300 American Express gift card was offered as an incentive in 2007 and a $200 American Express gift card was offered as an incentive for 2008 and 2009. Where available, four-year comparisons of survey results are provided. The analysis represents historical data and might reflect seasonal market fluctuations.

—Jennifer Zupnick

Senior Market Research Analyst, Jobson Optical

Senior Market Research Analyst, Jobson Optical