They may be pint-sized, but they are supersized in buying power and attitude. They are consummate consumers, courted by everyone from fashion designers and food manufacturers to giant retailers. They are the kids. And they are the future. Eyecare professionals, too, need to fully realize the impact of these young customers. Kids love fashion and they love accessories—that includes eyewear. Selling eyewear to children is no longer a category that can be handled with a small selection of product. It’s a full-blown business with a wide range of customers of varying ages, wants and needs.

According to respondents to 20/20’s Kids’ Eyewear MarketPulse Survey 2007, children from infancy to 14 years old represented 15 percent of their customer base in the past year and children’s eyewear and related products accounted for 12 percent of total gross dollar sales. Although more than half (54 percent) of those surveyed said their children’s business had stayed about the same versus five years ago, 38 percent did report an increase. But more significantly, 55 percent of the participants indicated their average children’s complete eyewear retail sale (excluding eye exam fee) increased in the last five years. In fact, the average retail sale for a kids’ frame rose to $120 in 2007 from $100 and $108 in 2006 and 2005, respectively. However, the average retail price for children’s spectacle lenses remained at $100, the same as in the previous year.

FACING THE CHALLENGES

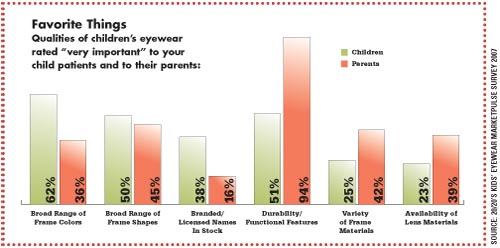

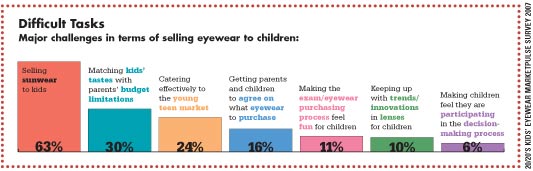

Although the children’s business is essential to the future of optical, it’s an ever-changing scene with its own specific set of challenges— most notably two sets of customers— the child and the parents—often with wants and needs that are at odds. What is very important to kids in eyewear is a broad range of color options, according to 62 percent of those surveyed. Only 36 percent indicated color was of major importance to the parents. What’s very important to parents is durability and functionality, cited by 94 percent as a key concern. Interestingly, though, a substantial 51 percent say durability and functional features in their eyewear is very important to children. Also of interest was both parents and children seemed to have a similar desire for a variety of frame shapes, with 45 percent of those surveyed reporting shapes were of major interest to parents and 50 percent to the kids.

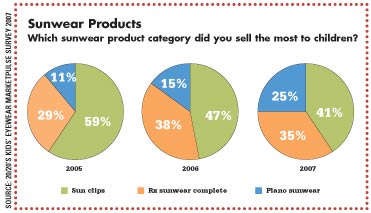

What is a major challenge, 63 percent of the survey respondents reported, is selling sunwear to children, with an additional 28 percent saying it’s a minor challenge and only 8 percent finding it no challenge. The main reason for this is undoubtedly that parents are reluctant to spend money on eyewear likely to be lost or forgotten. Fortunately, because of the necessity of protecting young eyes from the sun, there is a brighter side. Of those surveyed in 2007, 76 percent said they sell sunwear to children. The most popular sun item—and least costly—dispensed to kids was the clip-on, cited by 41 percent of the respondents. Rx sunwear accounted for 35 percent and plano sunglasses for 25 percent of all sunwear sold to children by the 2007 participants.

On another positive note, a significant 86 percent of retailers said they sell protective sports eyewear to children. And 85 percent reported dispensing contact lenses to kids, an option especially for children active in sports.

In regard to lens materials, polycarbonate is clearly the buzzword—no doubt as a result of eyecare professionals keeping parents informed on the necessity of impact-resistant materials. Of those surveyed, 66 percent reported polycarbonate lenses made up a greater proportion of total children’s eyewear dollars than it did five years ago.

With frame materials, metal is still generally preferred for children because of its easier adjustability. But following the trend in the adult market, plastic is also showing gains in kids’ eyewear sales. Of those surveyed in 2007, 43 percent reported an increase in frame dollar sales attributed to plastic materials in the last year and 33 percent cited an increase for metal frames.

In one area, though, the kids’ market does not seem to be taking its direction from the grown ups. Although brands continue to be of major interest in the optical world in general, those surveyed reported only 32 percent of their total children’s frame sales were in branded or licensed frames in the last year, comparable to the 30 percent reported for the previous year. Additionally, only 33 percent of the retailers reporting in 2007 said the percentage of their total children’s frame dollar sales volume generated by branded names has increased in the past five years.

From this survey, it’s apparent the kids are all right. With a concerted effort on the part of ECPs, the business generated can be far better than all right. But it will take time and energy before kids’ eyewear achieves its potential as a grown up business.