L&T takes the pulse of the spectacle lens market with the 2011 Premium Lens MarketPulse Survey of Eyecare Practitioners. This annual, qualitative survey provides fresh feedback from independent eyecare practitioners about sales of the spectacle lens designs, materials and treatments they prescribe and dispense.

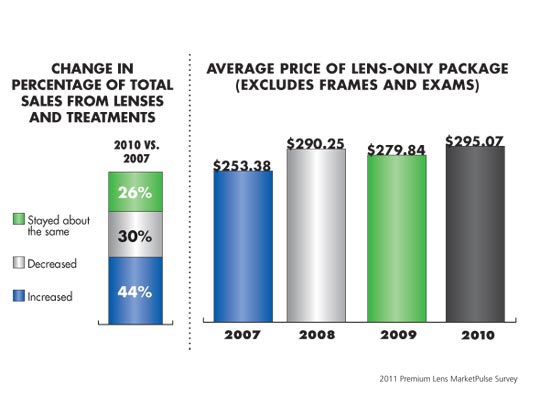

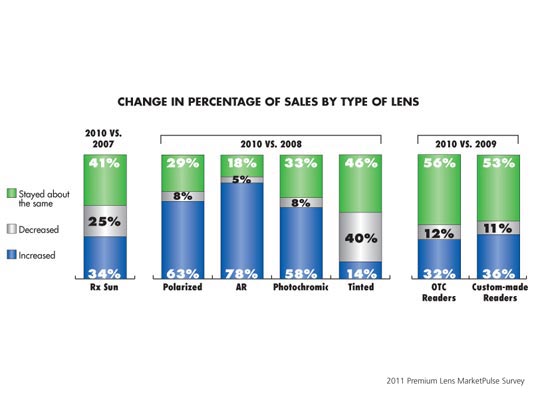

Compared to three years ago, 44 percent of retailers said that in 2010, spectacle lenses and treatments made up a larger percentage of their location’s total gross dollar sales. This percentage has decreased steadily since 2007. Conversely, there has been a steady increase in the percent of retailers saying their sales have decreased over the last few years, with the highest being 30 percent in 2010. Thirty-four percent said that Rx sun lenses as a percentage of total dollar sales increased over three years ago.

LENS SALES

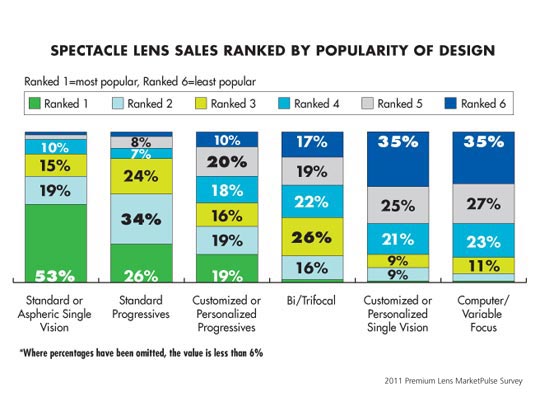

When asked to rank lens design by popularity, standard or aspheric single vision was ranked highest in popularity by 53 percent of retailers. Standard progressives were top ranked by 26 percent and customized or personalized progressives were top ranked by 19 percent. Fifty-eight percent of retailers said short corridor lenses made up a moderate percentage (11 to 49 percent) of their total progressive lens pair sales.

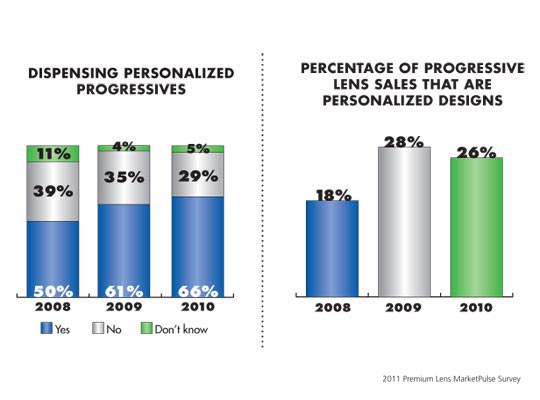

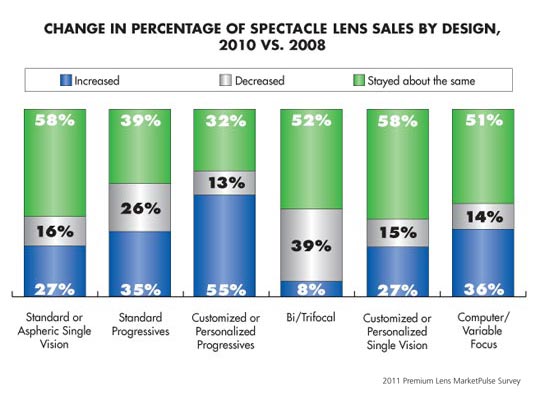

More than half (55 percent) of retailers said customized or personalized progressives lenses made up a greater proportion of their total lens sales in 2010 than they had in 2009. Comparatively, 41 percent said standard progressive sales had increased over the last year, while 52 percent said that sales of bifocals and trifocals had decreased as a percentage of total lens sales over the last year.

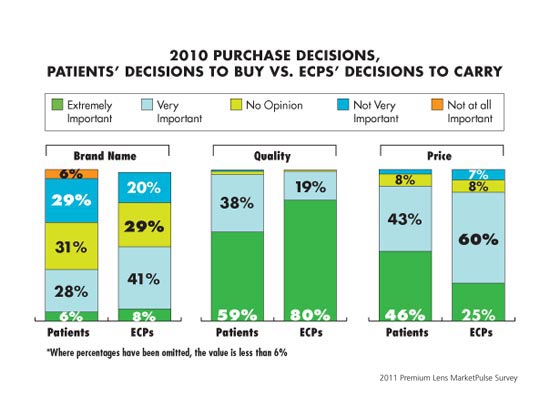

Forty-one percent of retailers said brand name is very important regarding decisions as to which lenses to carry. Also, 80 percent of retailers said quality is extremely important when it comes to deciding which lenses to carry. Ninety-seven percent of retailers said quality is very or extremely important to their patients regarding their decision as to which lenses to purchase. Forty-six percent of retailers said price is extremely important to patients in regard to their decision as to which lenses to purchase.

PROGRESSIVES

Forty-eight percent of retailers agree with the statement, “I promote the use of progressive lenses to all my presbyopic patients, including those who currently wear bifocals or trifocals.”

When asked about familiarity regarding new progressive lens technologies, 93 percent of respondents were aware of the terms “free-form” and “customized.” Eighty-eight percent were aware of the term “personalized,” and only 55 percent were aware of the term “contrast enhancing.” Seventy-six percent of respondents said they are very or extremely satisfied with the personalized progressive lenses they dispense.

COMPUTER/OFFICE LENSES

Most retailers surveyed (62 percent) said computer/office lenses make up an insignificant percentage (10 percent or less) of their total lens pair sales.

LENS MATERIALS

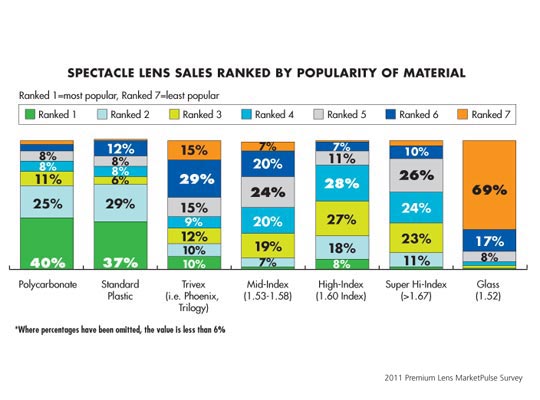

When asked to rank lens material by popularity, polycarbonate was top ranked by 40 percent of the retailers. Standard plastic was top ranked by 37 percent. Glass was ranked least popular by the most retailers (69 percent).

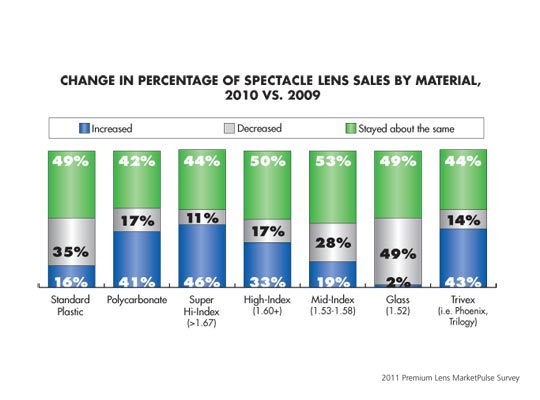

Forty-one percent of retailers said their 2010 polycarbonate lens sales increased as a proportion of total lens pair sales compared to 2009. Forty-six percent said their sales of super high-index lenses had grown since 2009, and 43 percent said Trivex sales had increased over the last year. Fifty-three percent said their mid-index lens sales had stayed flat. Glass was the worst performer, with 49 percent saying that glass made up a smaller proportion of their total lens sales in 2010 than in 2009.

HIGH-INDEX LENSES

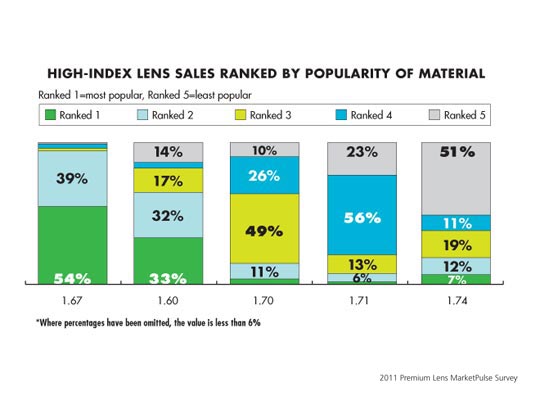

When asked to rank high-index lenses based on popularity, 54 percent ranked 1.67 as most popular and 33 percent ranked 1.60 as most popular. Comparatively, 1.74 was ranked least popular by 51 percent of retailers.

LENS TREATMENTS

An impressive 78 percent of retailers surveyed said they had experienced an increase in AR lens sales as a proportion of total lens sales in 2010 versus 2008. Sixty-three percent saw an increase in polarized lenses and 58 percent saw an increase in photochromic sales over the same period.

For 40 percent of retailers surveyed, tinted lens sales stayed about the same compared to the year before.

Seventy-eight percent of retailers said they offer two different price points for AR lenses—one being standard, the other being premium. This is up from 71 percent in 2009.

IMPACT OF REFRACTIVE SURGERY

Thirty-nine percent of retailers agree that because of the increase in patients having refractive surgery, their sales of reading glasses have increased while 28 percent say specifically high-powered lens sales have decreased.

READING GLASSES

For some retailers (45 percent), reading glass unit sales stayed about the same in 2010 compared to 2009. Forty percent of respondents experienced an increase in readers sales over this time period. Among those who sell readers, 32 percent said that their OTC/ready-made readers sales had increased in 2010. Custom-made readers sales were relatively flat for half (53 percent) of respondents at locations that sell readers.

LENS PACKAGES

Forty-two percent of retailers say they do use lens-only package pricing. The average price of this lens-only package was $295.07 in 2010.

Methodology

This sample was derived from the proprietary Jobson Optical Research database. This survey was conducted by Jobson Optical Research’s in-house research staff. Data collection was conducted in February 2011. Only the responses of independent optical retailers who dispense premium lenses are included in the report. The sample consists of 214 independent optical retailers. All participants were recruited by e-mail and the questionnaire was completed via the Internet. Four years of data is provided for comparisons where possible. For more information or to purchase the complete 2011 Premium Lens MarketPulse Survey visit jobsonresearch.com.

—Jennifer Zupnick

—Jennifer Zupnick

Senior Research Analyst

Jobson Optical Research