| New Products |

|

|

| |

|

Operating Strategies |

|

|

Bob Niemiec |

Digital Surfacing is the Future

If you've spent any amount of time in this industry, as I have over the last 15 years, you've seen a number of things come and go. Certainly, changes in frame styles have dictated changes in lab manufacturing methods and equipment. Large eye sizes, small, narrow B eye sizes, three-piece mounts, to name a few trends, have all presented challenges to the lab. Various other methods of lens processing have arisen and have either disappeared or never lived up to their original promise.

One technology I believe has a significant place in optical retailing, wholesaling and manufacturing is direct surfacing, also known as digital surfacing and free-form. Never before in the optical industry have I seen such a commitment in terms of R&D, brainpower and capital in any one technology.

Still, effort and investment even of this magnitude is no guarantee of success. Digital surfacing holds the real promise of insuring greater product consistency, lowering costs and complexity while providing the customer with an even greater product variety than exists today. Increasingly, those who are jumping into digital surfacing are realizing this promise.

For the lab owner/operator direct surfacing presents a number of challenges. Capital, both human and financial, is one of the biggest issues that needs to be addressed. Financially, because digital surfacing is a process that requires an integrated suite of equipment, investment to get in the game can run well over $500,000. Further, lab technicians needs to understand the relationships between the process, the software and the desired lens design at a level well beyond what exits today in most conventional processing labs. While great strides have been made, I don't believe digital surfacing is yet at the “plug and play” state of development of conventional lens processing. Additional issues remain around patents and licensing that need to be understood and addressed.

Nevertheless, digital surfacing is most likely the future of lens processing. As an old professor of mine once said, “You can always tell who the pioneers are, they're the ones with the arrows in their back.” As digital surfacing moves beyond the pioneer stage, when do you want to jump in?

—Bob Niemiec is president of Optinova Solutions, LLC, a consulting firm specializing in operations improvement, new technology assessment and mergers and acquisitions, primarily in the optical industry. An optical industry veteran, he has held senior level positions in manufacturing and distribution with large optical retailers and manufacturers. He can be reached at

[email protected]. |

| |

|

Tech Talk |

|

Fining and Polishing Fundamentals,

Part 2

Polishing is the last alteration done to a lens, and should remove all remaining imperfections. AR and backside coatings will magnify any problem polishing either creates or doesn't remove. A common human error at fining is picking the wrong lap tool. Unwanted prism and off-powers may indicate the wrong lap tool was used. Lap tool selection solely is based on the operator. Keep the lap tools organized, making sure your employees understand the system.

As of yet, there is no bar code system for lap tools or software checks to verify if the proper lap tool is used. Remember, these are precision tools and delicate. Keep them clean and dry. Treat with care, do not mishandle, and maintain and re-true them. Unwanted prism and other distortions will be caused by bad lap tools and many labs find that after checking everything else out and the problem is still not eradicated, bad lap tools are often the cause. Many lab managers find spoilage rates decline simply by replacing the lap tool inventory.

Read "Fining and Polishing

Fundamentals, Part 1."

|

| |

|

HR Corner |

|

Finding, Keeping and Rewarding Staff

Human resource management will become increasingly challenging in the next five to 10 years, according to Global Human Resource—The 20 Worst Mistakes that Companies Make, a report published by the

Economist Intelligence Unit. The report highlights the need to increase the time and effort dedicated to human resources in order to be successful in an increasingly competitive market.

The report cites the shortage of talent as one key area which will become more difficult as time goes on. This applies directly to eyecare professionals who seek highly qualified, experienced, talented and customer-focused team players.

As business organizations and eyecare practices struggle to meet the demands of customers, the real competitive advantage will stem from human resources.

The report further cites several key issues which it states “tend to be the same everywhere:”

Finding staff, keeping them and rewarding them appropriately are identified as three major problems in human resource management. “If you can get the best 1-2-3 staff members for your eyecare practice, then this will generate the crucial competitive advantage,” according to the report.

Hedley Lawson brings over 25 years of optical industry experience to Jobson Medical LLC. For over 10 years, he has been a contributing editor to VM, most recently as writer of the monthly column “Business Essentials.” He is the Contributing Editor of VM's E-Newsletter

Business Essentials. |

|

|

Assessing Financial Performance,

Part 1

Do you really know the true financial performance of your lab? In order to thrive or survive, lab owners must be able to assess the performance of their businesses, respond to potential threats, and act upon opportunities better than the competition. There is no better source of information to these than the lab's financial statements, and the financial statements are only as reliable as the company's reporting system which includes personnel, software, and procedures used in their preparation. Financial statements are worthless unless they are timely, accurate, consistent, comparable and analyzed by management thoroughly.

The most important people in the financial reporting cycle are owners, CPA’s and the company’s bookkeeper. Owners are ultimately responsible for the wellbeing of the business and understanding the reporting that leads to good decision making. Hiring a trustworthy CPA to assist in setting up a reporting program and assistance in interpreting the business' results will enhance the quality of information and provide insight toward making good decisions. Finally, having a good bookkeeper understanding of financial reporting will aid in reporting results correctly and in a timely manner. With respect to reporting, we will discuss the following in future articles:

Reporting Do's

-

Prepare monthly internal financial statements.

-

Have your accountant compile financial statements on at least a quarterly basis.

-

Allow for warranties, redo's, inventory obsolescence, bad debts, vacation, and discounts on the balance sheet.

-

Prepare internal and external financial statements on an accrual basis (not cash).

-

Perform a physical inventory and adjustment to book inventory on a quarterly basis.

-

Report revenue and expenses in the proper period.

Reporting Don'ts

-

Run personal expenses through the business (this can distort results).

-

Wait until a third party plan pays to know how much you are owed.

-

Avoid paying taxes by adjusting your financial statements.

-

Expense items that should under GAAP be capitalized.

-

Treat the business as anything but an investment that has a fiduciary duty to its owners and associated accountability.

-

Consolidate accounting, billing, payables, and collections responsibilities within the same person absent meaningful oversight.

Poor financial reporting may cause serious consequences. Without close examination of accurate results, lab owners could make poor or uninformed decisions such as those effecting capital investment, debt, sales and marketing, personnel acquisition and retention, expense management and tax audit exposure.

With pressure from customers, manufacturers, third party plans, etc., today's competitive market, the independent lab owner requires sound financial reporting in order to compete and maintain a healthy company.

—Jason A. Meyer is senior vice president, HPC Puckett & Company. Based in San Diego, Calif.,

HPC Puckett & Company specializes in mergers and acquisitions of wholesale optical laboratories. You can send comments or questions about this article or any other Dollars & Sense articles to Jason Meyer at

[email protected]. —Jason A. Meyer is senior vice president, HPC Puckett & Company. Based in San Diego, Calif.,

HPC Puckett & Company specializes in mergers and acquisitions of wholesale optical laboratories. You can send comments or questions about this article or any other Dollars & Sense articles to Jason Meyer at

[email protected].

|

|

| |

|

|

|

Fracturing Polycarbonate Lenses on Nylon Mounts

“I was having an issue with polycarb lenses, mainly progressives fracturing on nylon mounts. I edge on a 2007 Essilor Kappa CT edger with all computerized controls. We had two jobs with polished edges, front bevels and AR coating. One job fractured at the upper nasel corners, while the other job fractured along the top of the frame. The lenses did not seem to be oversized as the cord snapped in comfortably. The frames were standard metal, not titanium.

“I asked a lot of questions of other lab managers, as well as

Gerber Coburn. They pointed out that polycarb is a very stressful material to work with. Changing orders to Trivex or high-index has been a big recommendation, since not only is the material optically sharper but also has a lot lower stress point.

“As far as my edger goes, Gerber Coburn suggested I run poly thin lenses on the glare free coating cycle, which not only slows down the roughing cycle to reduce heat build up, but also cuts back on the chuck pressure, reducing flexing. This will cut down on stress and fracturing down the road.” |

|

| |

|

|

Dallas Erickson of Soderberg, Inc.

Dallas Erickson started working with

Soderberg in March of 2005, immediately after earning her B.A. in Business Administration/Marketing from Augsburg College in Minneapolis. Two months later, Soderberg merged with

Walman Optical. Dallas Erickson started working with

Soderberg in March of 2005, immediately after earning her B.A. in Business Administration/Marketing from Augsburg College in Minneapolis. Two months later, Soderberg merged with

Walman Optical.

“This was an interesting time to start with a company, as I was trying to get the hang of my new position as marketing assistant, while experiencing my first business merger between two major competitors,” Erickson said. “I think I speak for many when I say it has been great for Soderberg and all of the Walman family of companies.”

Erickson was promoted to marketing coordinator when the former marketing manager resigned in August 2006. She now manages the Soderberg marketing department and develops promotions and tools for their customer service reps, territory and branch managers enabling them to educate and service the customers on a consultative basis.

“We have a strong management team that is focused. We work diligently to develop goals and strategies for the entire Soderberg network each year,” said Erickson. “Everything I do supports our initiatives directly, or indirectly so everyone in the division is on the same page.”

Each day in the office Erickson reports to having several projects she's working on. “I'm always busy and if I get stuck on something, I can switch gears for a bit,” she commented. On any given day, Erickson can be found developing a program or promotion, meeting with a vendor, analyzing reports, setting-up seminars, pricing, learning and/or educating others. Recently, she has started to travel with Soderberg's territory managers out in the field.

“This one-on-one experience with our customers has given me a better understanding of their needs and wants,” Erickson said. “It has not only given me a better insight to our industry from their point-of-view, but also tweaked the way I have done things from a corporate standpoint.”

Erickson reports the highlight of her career happening earlier this year when Soderberg received the honor of Transitions Lab of the Year for 2007. This was the first award Soderberg had received since she started with the company in 2005.

“Although it took the entire Soderberg team to accomplish,” Erickson noted, “I couldn't be more proud as if it was my own. We not only made a commitment to increase our Transitions sales, but we partnered with our accounts to show them the health benefits of the product to the patient and the growth potential Transitions can do for the independent practice.”

Erickson's future goal is to grow as a leader at Soderberg. “As I look at the leaders we have in place now, it would be a true honor to be categorized in the same group,” she said. Craig Giles, vice president and general manager of Soderberg, commented, “Dallas is driven to do well and desires to see results in the marketing projects she takes on for our division. She doesn't measure her success by how many hours she puts in. She measures success by the results she and her team achieve on an initiative.”—Samantha Toth |

|

| |

|

|

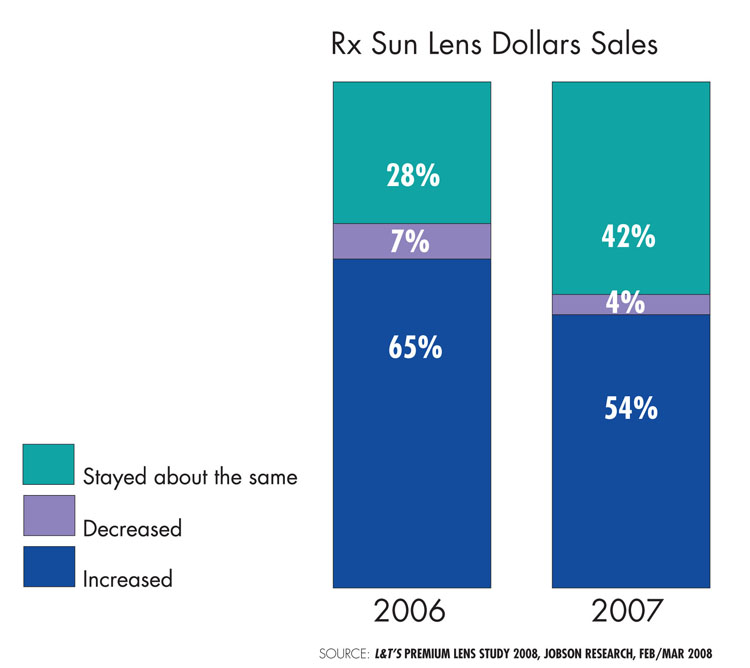

Lenses by the Numbers, Part 1

New market research data from Jobson Research provides fresh feedback from eyecare practitioners about sales of the spectacle lens designs, materials and treatments they prescribe and dispense. By analyzing the results of L&T's 2008 Premium Lens Study of Eyecare Practitioners, which polled 303 independent optical retailers across the country, we learn which products they think are hot and which ones are not compared with last year.

Here are some highlights from the survey results.

Total Sales

Compared to three years ago, 74 percent of retailers say that in 2007, spectacle lenses and treatments made up a larger percentage of their location's total gross dollar sales. This is up from 72 percent in 2006.

There was also a decrease in the number of retailers who say spectacle lenses and treatments made up a smaller percentage compared to three years ago, going from 8 percent in 2006 to 5 percent in 2007. Fifty four percent say that Rx sun lenses as a percentage of total dollar sales increased over 3 years ago.

Lens Sales

When asked to rank lens design by popularity, single-vision was ranked 1 by 62 percent of retailers. Progressive (including short corridor) was ranked 1 by 32 percent. Sixty one percent of retailers say short corridor lenses made up a moderate percent (11 percent-49 percent) of their total progressive lens pair sales.

Almost half (49 percent) of retailers say that single-vision lenses made up a greater proportion of their total lens sales in 2007 than they had in 2006. Comparatively, 84 percent say progressive sales had increased over the last year, while 46 percent say that sales of bifocals and trifocals had decreased as a percentage of total lens sales over the last year.

Forty six percent of retailers say brand name is very important to them regarding their decision as to which lenses to carry. Also, 77 percent of retailers say quality is extremely important to them regarding their decision as to which lenses to carry.

Ninety three percent of retailers say quality is very or extremely important to their patients regarding their decision as to which lenses to purchase. Forty percent of retailers say price is extremely important to their patients in regard to their decision as to which lenses to purchase.

Eight one percent of retailers agree with the statement, “I promote the use of progressive lenses to all my presbyopic patients, including those who currently wear bifocals or trifocals.”

Computer/Office Lenses

Computer vision sales have stayed about level, with 54 percent of retailers saying their sales in this area have remained unchanged. Most retailers surveyed (66 percent) say computer/office lenses make up an insignificant percentage (10 percent or less) of their total lens pair sales.

Look for more lens study highlights next month. |

| |

|

|

Nikon Acquires Minority Stake in Encore Optics—

Nikon Optical USA, a subsidiary of the Nikon-Essilor joint venture, has acquired a minority stake in Encore Optics LLC, an independently owned prescription laboratory in South Windsor, Conn. The move raises Nikon's profile in the U.S. while giving Encore exclusive rights to produce and distribute the full range of Nikon's advanced optical technologies to the Northeastern U.S. market.

In addition to distributing Nikon's full-range of optical products, from advanced aspheric single-vision to digitally surfaced progressive lenses, Encore will work with Nikon to introduce Nikon's family of lens coatings. The companies have established a Nikon coating facility within Encore Optics' laboratory in Connecticut.

|

|

Paul Zito of Encore Optics at a Nikon party at International Vision Expo West 2007. |

|

|

Nikon executives Rick Davis, left, with Antoine Amiel hosted the event, which was held at the Pure nightclub at Caesar's Palace in Las Vegas. |

“We believe the synergies between Nikon's premium high-technology products and Encore Optics' high-quality lab service and processing expertise are a perfect combination for independent eyecare professionals seeking to differentiate their practices,” said Antoine Amiel, president of Nikon Optical USA, based in Melville, N.Y. “This differentiation will be seen through the best products, lab-service support and a recognized and trusted consumer brand.”

Nikon Optical USA is Nikon's fourth ophthalmic-dedicated subsidiary in addition to Nikon Optical Canada, Nikon Optical UK and Nikon Optical Beijing. Drawing upon its expertise in optical precision instruments, Nikon has pioneered many new technologies applied to ophthalmic lenses, especially in the field of advanced aspheric lens designs, high-index plastic lenses and super scratch-resistant, anti-reflective coatings.

Nikon Optical USA Inc. distributes premium ophthalmic lenses, materials and coatings including Nikon W and Presio i progressive lenses, a full-range of stock Nikon anti-reflective coated aspheric single-vision lenses, standard 1.50 index up to 1.74 ultra-high index material and now Nikon anti-reflective coatings HCC, ECC and SeeCoat.

Encore Optics, founded in 2003 by Paul and Ivy Zito, is a full-service wholesale laboratory providing support and products to eyecare professionals in New England and the Hudson Valley.

Italee Implements Essilor's 360º Digital Surfacing Technology—The most recent independent lab to add digital PALs to its product mix is

Lab Italee. Last month, Essilor of America announced the completion of the first-ever technology transfer of its patented 360º Digital Surfacing process at California-based lab. With access to Essilor's 360º Digital Surfacing technology, Italee can now fully manufacture Varilux lenses on its California campus, including Varilux Physio 360º, Varilux Ellipse 360º and Varilux Comfort 360º in a wide range of materials, including the new Transitions VI line.

“Essilor is proud to share our industry leading, state-of-the-art 360º technology with Italee,” said Bob Colucci, president of Essilor's Independent Distribution Division. “The Essilor technical team was involved during every step of the installation at Italee, ensuring total process integration, from lab management systems to lab process re-engineering.”

Italee's new digital surfacing facility operates Essilor's proprietary and patented equipment and process. A remote daily quality certification of the process has been set up with Essilor to ensure design compliance and guarantee consistency and quality control.

LensStock Offers Real-time Lens Availability Reporting Anniversary—

LenStock.com now offers real-time lens availability reporting. LenStock is a business-to-business Web site that enables eyecare professionals to quickly and easily order all major brands of stock lenses to be drop shipped by the Global Optics warehouse, housing over 34,000 square feet of lenses. LenStock.com is the only Web site providing eye care professionals with direct access to the Global Optics lens inventory, the largest in the U.S.

Global Optics is an exclusive optical group consisting of independent optical wholesale laboratories from across the country. Formed in 1971, Global Optics’ mission is to provide independent laboratories a means of sharing ideas and goals that lead to better service and product quality for eyecare professionals.

Real time lens availability reporting provides eye care professionals with the exact number of lens on hand and ready to ship in the Global warehouse. As orders are placed ongoing throughout the day, LenStock.com updates the availability numbers real-time reflecting the most up-to-date quantities available. When lenses are in-stock, most LenStock.com orders ship out of the Global warehouse the same day. This is a huge benefit to eye care professionals as it helps them avoid receiving partially filled orders. Instead, many of them are able to substitute for a comparable product avoiding a delay for their patient.

LenStock account access is exclusively available from Global Optics member laboratories including: Cherry Optical, CVO, Dietz Laboratories, Emagine Optical, Encore Optics, Expert Optics, Harbor Optical, Hirsch Optical Corporation, iCare Labs, Katz & Klein, Lenco, LensTech, Pech Optical, Professional Ophthalmic Labs, QC Optical, Rite Style Optical, Rooney Optical, Soderberg Optical, Toledo Optical and Walman Optical. | |

|

|

|

Ultra White

Manufacturer: Dynamic Labs

Description: Quick release blocking pad

Features: Like Dynamic Labs' Ultra Blue pad, the Ultra White pad is designed to adhere extremely well to the lens but is simple to deblock.

Availability: 1,000/roll

(888) 339-6264

www.dynamiclabs.net |

| |

|

Autograph Progressives

Manufacturer/Distributor: Shamir Insight

Description: Enhanced line of personalized, Freeform progressive lenses

Features: Shamir Autograph lenses have been updated with a variable lens design for minimum fitting heights starting from 1mm and up. The new line extensions are Autograph Attitude, which provides patients with a premium wrap progressive with optimal zone widths and clear, distortion-free viewing; Autograph Office, a personalized occupational lens.

Availability: Autograph Single Vision, which allows single-vision patients to experience personalization in a fully aspheric back-surfaced lens; Autograph Single Vision Attitude, which provides a customized lens for wrap frames, without the distortion found in many progressive wrap lenses.

The new Autograph lenses feature As-Worn Technology and FreeFrame Technology. As-Worn Technology fine-tunes a patient's Rx by calculating vertex distance—the distance between the lens and the eye; pantoscopic tilt—the angle at which the frame sits on the patients face; and panoramic angle—the angle of the frame itself. Submitting these three measurements along with the patient’s Rx allows Shamir’s Prescriptor software to adjust the prescribed Rx to better suit the patient as he or she wears the frame. FreeFrame Technology, takes into account the patient’s frame choice, adjusting the design of the lens by dynamically increasing or decreasing the corridor length to match the frame and fitting height. Also, by moving the reading zone to the exact location in relation to the patient’s selected frame, FreeFrame Technology ensures each patient receives wide reading areas with full add for any frame shape or structure.

(877) 742-6471

www.shamirlens.com |

| |

|

Ergo Pliers

Manufacturer/Distributor: Vigor Optical

Description: Ergonomic pliers

Features: All new ergonomic pliers dispensing combination packed in a handy leatherette case. Kit includes seven dispensing pliers. 1 each: nosepad adjuster, long jaw chain /snipe nose, angling/panto adjuster, their most popular endpiece angler, a wide jaw nylon flat bracer, compression bushing bracer and midget lens aligner.

All of Vigor's ergonomic pliers have conventional jaws with elongated ergo shaped handles for increased leverage and torgue. The pliers also have comfortable cushion grips.

(800) 847-4188

www.vigoroptical.com |

| |

|

|

Tool Magnetizing Tower #2184

Manufacturer/Distributor: Western Optical Supply (WOS)

Description: Magnetizer for driver blades and plier tips

Features: WOS' Tool Magnetizing Tower provides a continuous magnetic charge to hand tools when they are inserted into this tool holder. The TMT is an easy and efficient way to magnetize drivers, tweezers, chain nose pliers, as well as WOS’ Universal Screw and Nut Grabber, enabling technicians to pick up small screws and findings that can be attracted to a magnet. The Tool Magnetizing Tower holds 12 tools (not included).

Size: UltraThin 1.67, DiamondClear polycarbonate and Ultra 1.50 plastic. The product range for the 1.67 index is -2.00 to -8.00D, and in polycarbonate +3.00 to -6.00D, both out to a -2.00 cylinder. Product range for 1.50 index is +3.00 to -4.00, to a -2.00 cylinder, with a total power of -4.00.

(800) 423-3294

www.westernoptical.com |

| |

|

Drivewear Polycarbonate

Manufacturer/Distributor: Younger Optics

Description: Drivewear Activated by Transitions lenses in polycarbonate

Features/Functions: Drivewear lenses combine Transitions Photochromic Technology and NuPolar polarization. Designed specifically to meet the visual demands of driving, Drivewear is the first polarized photochromic lens to darken behind the windshield of a car, which enables Drivewear lenses to change color based on current driving conditions in order to enhance the driver's vision. In addition, Drivewear lenses are polarized to block glare.

Availability: Single-vision

(800) 877-5367

www.drivewearlens.com |

| | | | |

| In This Edition...

|

| |

|

•

Subscribe to Lab Advisor

The monthly update for Optical Laboratory Owners and Managers

•

Forward this issue of Lab Advisor to a friend or colleague

•

Print this issue of Lab Advisor

•

Stay on top of optical industry news!

Subscribe to our other

e-newsletters:

•

VMail Extra

•

Business Essentials

If you have lab news or want to share information about technical topics, please

contact us.

Or

contact

Andrew Karp,

Editor-in-Chief

Visit

LabTalkonline.com for additional articles of interest about labs. |

| |

| |

|

| |

LabTalk Spotlight

May 2008

The anti-reflective (AR) coating market is finally seeing the increase in the U.S. that has been strong everywhere else in the world. According to Andy Huthoefer, vice president of business development for Satisloh, the market has increased significantly, from 17 percent of pairs sold in 2002 to 29 percent in 2007, or ± 20,300,000 pairs.

In the May/June issue of LabTalk, you'll find, “AR Is In the House — Is Investing in AR Right for You?” by Linda Little.

Here's an excerpt:

“Overcoming many obstacles, not the least of which was turn around time for this add-on, dispensers are becoming more comfortable and educated to recommend this product to their patients. Large labs and corporations are advertising the benefits of AR coating to consumers and dispensers. On a national basis, the AR Committee, a committee of the Vision Council of America, is dedicated to growing the AR lens market.

“We'd like to see the percentage of AR coated lenses increase to that of the European market which is approximately 70-80 percent of lenses sold,” explained John Quinn, chair of the AR Committee and president of LTI.

“AR coating is one of those bright areas in the industry,” Quinn added. “There is an opportunity for the labs to make money. Premium products are the key and AR is not only a premium product, it is a better product for the patient.”

So the market is growing, the need has developed and probably not going away. So the question independent labs should be asking themselves—is this the time to have an AR coating facility in-house?

“Every lab should be offering AR coated lenses today,” according to Quinn. “There is a low penetration of the market, about 30 percent; the good growth is in front of us. A high percentage of optical labs are offering AR coating today, however, the decision to continue with an outside service or bring the process in house is a big step.”

To read the entire article, “AR Is In the House” log on to

http://www.labtalkonline.com/. Here you will find the article listed under the Features section.

|

|

Buying Group & Lab Association News

Optical Services International Holds Winter Meeting—Norcross, Ga.—

Optical Services International, a leading association of independent wholesale laboratories, recently completed their winter meeting at St. Kitts, West Indies.

|

| Danna and Bob Dahl of Southwest Lens were among the attendees. |

|

| Donna Vernier of Transitions Optical and Dale Parmenteri of Balester Optical enjoying some downtime during the meeting. |

|

| At the OSI meeting in St. Kitts, West Indies are, left to right, Scott Betcher of Transitions, Dana Weeks of OSI, Jeramie Register of Opti-Matrix, Dale Parmenteri of Balester Optical and Jim Evans of NEA Optical. |

Steve Kodey with The Vision Council started the meeting with a 2007 market overview and outlook. The discussion led to the development of new programs for 2008.

Donna Vernier and Scott Betcher with Transitions Optical, debuted an exclusive OSI program for 2008. It will be presented to the market place in late second quarter of this year.

A new ECP practice building program was discussed and will be available later in the year. Each participating office will be given step by step programs to build their business.

“This was an excellent and productive meeting,” said Dana Weeks, president of Optical Services International. “The upcoming programs that the ECPs will have access to through OSI members are some of the best we have ever offered.”

OSI Members will hold their next meeting in conjunction with Vision Expo West.

COLA Hosts Annual Spring Meeting

By Christie Walker

EL CAJON, Calif.—West Coast optical laboratories and vendors gathered at the Sycuan Resort here for the

California Optical Laboratories Association (COLA) annual spring meeting. At the President's Reception and Dinner, Terry Yoneda, sales representative for Younger Optics, was presented with the 27th annual West Coast Good Fellow Award. The Good Fellow is presented alternatively each year to a West coast lab employee and a vendor for his or her contributions to the optical industry and an “all around good fellow.”

|

| John Linn, Polycore and Gary La Gree, Younger Optics, get together at the COLA President's Reception. |

|

| Glenn Phelps, Express Lens Lab, Gary Peterson, PSI, and Bill Ball, DVI, gather to honor the West Coast Good Fellow. |

|

| Laurie Badone, Seiko and Chip Heavican, DAC, come together at the COLA event. |

|

| West Coast Good Fellow, Terry Yoneda (left), accepts his award from Richard Sellinger of Vision-Ease. |

|

| Outgoing president, Keith Grossman, Empire Optical accepts a thank-you plaque from incoming president, Tim Steffey, Sunstar Optical. |

Yoneda started with Younger Optics in 1994 and before that worked for Hoya. “I've been in the optical industry over 30 years now. I would probably still be working in a liquor store if it wasn't for that very first opportunity in the optical industry,“ said Yoneda in his acceptance speech before his peers where he received the perpetual trophy and traditional putter.

The highlight of the vendor presentations on day two was a digital surfacing forum with a panel of industry representatives including Laurie Badone of Seiko Optical Products, Raanan Naftalovich of Shamir Insight, Bruno Salvadori of Signet Armorlite, Keith Cross of Younger Optics and K.C. Haffey of Essilor of America. Unlike other panel presentations, there were as many comments from the floor as there were from the panel members.

When the issue of machinery cost for optical laboratories was raised, it was Matt Schmidt-Wetekam, principal owner of Perfect Optics in Vista, Calif., who offered a solution.

“Just like a coating center, you can have a freeform center for other labs. Right now, Perfect Optics makes freeform lenses for twenty other labs,“ explained Schmidt-Wetekam.

Steele Young from Satisloh added, “We are in the early stages of eliminating the old way of making lenses. Satisloh is making a hybrid machine that can process both standard and freeform lenses.”

Mike Everhart, DAC Vision suggested, “Throw away the laps. Throw away the cylinder machines. Freeform is more than just for PALs. It's a better manufacturing process.”

Panelist Raanan Naftalovich, Shamir Insight, summed up the discussion with an iPod metaphor. “The music will continue to play but on a different machine.” | |