Fueled by wonderful new styles and collections, consumer enthusiasm for the hottest of accessories, the broadening awareness of the need for sun protection and retail’s growing focus on sun—ranging from expanded offerings to new shops dedicated to sunwear products—the sun is shining brightly on optical. But according to the findings of 20/20’s 2007 Sunwear Survey of Independents, there are still cool patches.

SUN SENSE

Of those surveyed, a significant 65 percent say their Rx sun business is on the rise. This, however, does reflect a decline from the previous three years, in which respondents reported a gradual increase from 73 percent and 74 percent, respectively in 2004 and 2005, to 80 percent in 2006. Participants expect total gross retail dollar sales generated by sunwear products to be approximately 9 percent for 2007, similar to the 11 percent and 12 percent reported respectively for 2005 and 2006.

Although clip-ons represented only 15 percent of retail sunwear dollars in 2007, they contribute substantially to the bottom line. Survey respondents report nearly 55 percent of all clips they dispense sell for between $21 and $60; slightly more than 31 percent retail for between $61 and $100 and nearly 9 percent sell for more than $100.

An especially positive figure in the survey is adults between the ages of 45 and 54 comprise 40 percent of those who buy prescription sunwear, up from 16 percent in 2004 and 22 percent in both 2005 and 2006. Unfortunately, those 55 and over only accounted for 3 percent of Rx sunwear buyers in 2007.

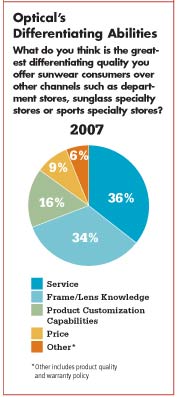

Of those polled, 65 percent feel their customers are more knowledgeable about sunwear than they were five years ago. In large part because consumers are better informed and have more sophisticated needs, they are more likely to turn to authorities in the field (ECPs) for their sunglass purchases. In fact, 36 percent of the surveyed independents rank superior service as the number one differentiating quality they offer over other channels of distribution, followed closely by frame and lens knowledge (34 percent). An additional 16 percent cited product customization as something their customers seek.

Indeed one noteworthy service that sets independents apart is customized Rx programs. Of those surveyed, 37 percent say they participate in prescription programs offered by name-brand sunwear/sports glass companies. This figure, which unfortunately dropped from 45 percent in 2005 and 40 percent in 2006, should be higher. Retailers need to follow the direction of vendors who have dedicated their efforts to creating programs that duplicate proprietary performance-oriented features in lenses.

The performance factor does bring up another aspect that has been beneficial to the sun business. The past few years have witnessed a definite merging between fashion-oriented sunwear and sports-oriented sunglasses. Fashion sunglasses, although designed for street and urban wear, often are available with a variety of performance features including polarization and grippable rubberized bridges and temple tips. And manufacturers are dressing up sport glasses with hot colors and contemporary shapes. In fact 46 percent of respondents feel the lines between the two categories are blurring. And of those who feel the lines are blurring, 72 percent think the merging is beneficial to plano and Rx sunglasses. In fact, the blending of the two areas should be beneficial to both sunglass and sports glass sales. Those individuals—reluctant to wear sports glasses because they often seemed unattractive—now have many satisfactory options. And performance features in fashion glasses appeal to those who think of themselves as having an active lifestyle.

Still another specialty item available to optical retailers is a selection of premium lens materials. Although the majority of sun lenses dispensed by respondents (43 percent for Rx and 52 percent for plano) is plastic, premium lens materials continue to gain share in the sun lens market. Polycarbonate now accounts for 37 percent of all Rx sun lenses dispensed, up from 32 percent in 2006, and 40 percent of plano sunwear, up from 35 percent in 2006. An additional 14 percent of prescription sun lenses are made of high-index plastic, up from 9 percent in 2006.

COOL PATCHES

Despite a generally favorable outlook for the sun business, there are definitely areas in which independents need to turn up the heat: namely, selling sunwear year around. The majority of respondents characterize sunglass sales as high only during July and August (67 percent) and May and June (53 percent) and tumbling for the rest of the year.

Another area in which optical falls short of its potential is in dispensing sunglasses to contact-lens wearers. Less than half of the retailers surveyed (46 percent) claim they always recommend their contact lens patients buy sunglasses. Even more alarming, only 15 percent say their patients make a sunwear purchase at the time they are fitted for new contact lenses.

It is clear optical has a rightful and respected place in the sun. The challenge—and the opportunity—is yours. But you must be prepared to dedicate a significant portion of your practice, your environment and your attitude to sunglasses. You must be prepared to turn up the heat.

METHODOLOGY

20/20 Magazine’s 2007 Sunwear Report is based on data collected from structured email interviews with 180 independent optical retailers and practitioners. This sample was derived from the proprietary Jobson Database. All participants were contacted via email invitation and offered an incentive of a chance to win a $200 American Express gift card. When information is available, four-year comparisons are provided. All interviews were conducted in November of 2007. Data is presented from a retailer’s or practitioner’s perspective and may reflect seasonal market and thus behavioral fluctuations.

Last year’s 118 participants were contacted by phone by Jobson Research’s in-house staff. All respondents were asked the same set of structured interview questions. No incentive was offered for participations. Interviews were conducted in October and November of 2006. Data from 20/20 Magazine’s 2004, 2005 and 2006 Sunwear Reports are included for trending purposes.

Note: Due to the limitations of a structured interview format, not all respondents provided complete answers to all survey questions.

20/20 Magazine’s 2007 Sunwear Report is based on data collected from structured email interviews with 180 independent optical retailers and practitioners. This sample was derived from the proprietary Jobson Database. All participants were contacted via email invitation and offered an incentive of a chance to win a $200 American Express gift card. When information is available, four-year comparisons are provided. All interviews were conducted in November of 2007. Data is presented from a retailer’s or practitioner’s perspective and may reflect seasonal market and thus behavioral fluctuations.

Last year’s 118 participants were contacted by phone by Jobson Research’s in-house staff. All respondents were asked the same set of structured interview questions. No incentive was offered for participations. Interviews were conducted in October and November of 2006. Data from 20/20 Magazine’s 2004, 2005 and 2006 Sunwear Reports are included for trending purposes.

Note: Due to the limitations of a structured interview format, not all respondents provided complete answers to all survey questions.

—Jennifer Zupnick and Beth Briggs, Research Analysts