One of the most crucial business decisions for any eyecare practitioner is choosing a wholesale lab. A working partnership with a wholesale lab can greatly improve an ECP’s business or practice. As in any relationship, it requires both sides to make an on-going effort to communicate clearly and consistently about their expectations and goals.

One of the most crucial business decisions for any eyecare practitioner is choosing a wholesale lab. A working partnership with a wholesale lab can greatly improve an ECP’s business or practice. As in any relationship, it requires both sides to make an on-going effort to communicate clearly and consistently about their expectations and goals.

When selecting a wholesale lab, experienced practitioners consider not only the factors that initially attracted them to a particular lab but also whether the lab has the necessary attributes to sustain a long and prosperous relationship. Although most ECPs want a lab that offers competitive pricing, the lab’s ability to help the ECP navigate the increasingly complex and competitive optical marketplace is often the crucial determinant.

As you’ll discover by examining the results of our annual L&T Wholesale Lab Usage survey conducted by Jobson Optical Research, most practitioners give high marks to labs providing a full palette of products and services. Simply put, ECPs want their labs to help them differentiate themselves from competitors.

—Andrew Karp

TOP ANALYSIS

For more information or to purchase the entire Wholesale Lab Usage MarketPulse study, click here.

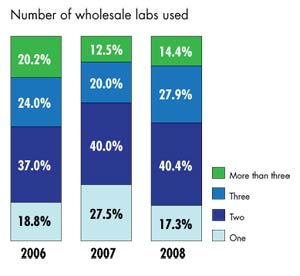

- About eight out of 10 (83 percent) of locations work with more than one wholesale lab.

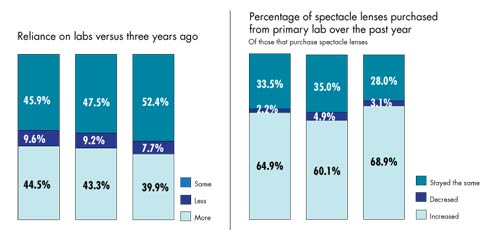

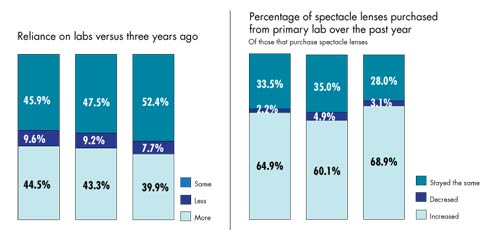

- Fifty-three percent expect to do more business with wholesale labs in the coming year. Only 2 percent expect to do less.

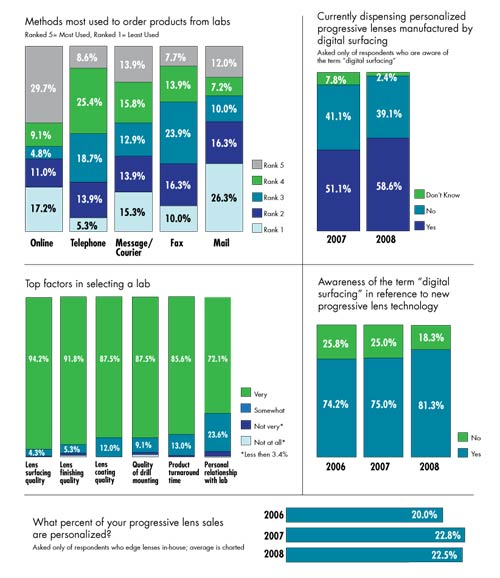

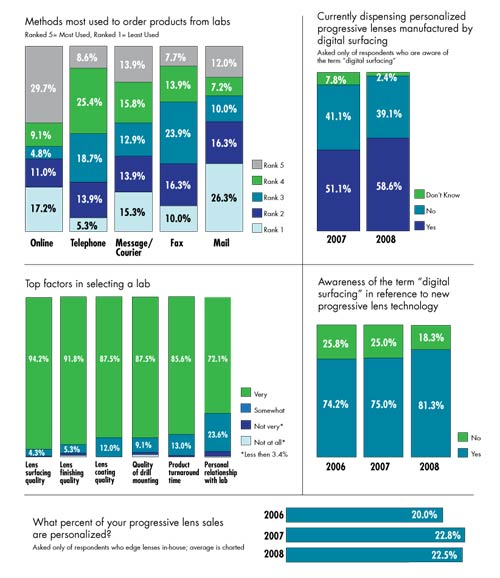

- The factors that were rated ‘very important’ in selecting a wholesale lab are based on the quality of services more so than the characteristics of the labs themselves (e.g. location). The most important factors in selecting a lab are lens surfacing quality (94 percent), lens finishing quality (92 percent), lens coating quality (88 percent), quality of drill mounting (88 percent) and product turn around time (86 percent).

- The majority of locations purchase spectacle lenses (93 percent), surfaced lenses (69 percent) and safety glasses (60 percent) from their primary lab.

- The services provided most often by the respondent’s primary lab were lens product information (89 percent), technical support (89 percent), and online ordering (84 percent).

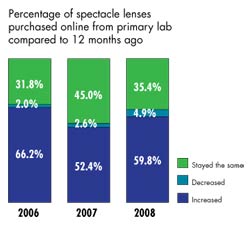

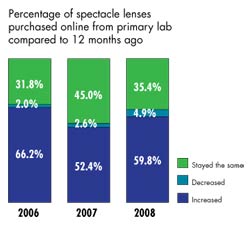

- Most labs that sell spectacle lenses offer online ordering; however, 64 percent of respondents have never sent in frame tracing data with an online order. Only 36 percent of respondents have ever sent in frame tracing data with an online order.

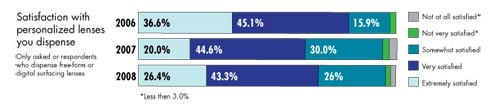

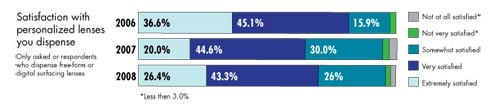

- About eight out of 10 locations are familiar with the lens technology term “digital surfacing.” Of those who are aware of this lens technology, 59 percent currently dispense progressive lenses manufactured by digital surfacing.

- Fewer of the locations have lens edging capability inhouse. In 2008, only 39 percent edged lenses in-house, down 12 percentage points from the previous year.

Methodology

20/20’s Lab Usage Survey 2008 was conducted during the August 18, 2008 to September 2, 2008 time period by Jobson Optical Research’s in-house research staff. The sample of 208 respondents was derived from the proprietary Jobson Optical Research Database.

The 2008 survey was conducted via the Internet and only eyecare professionals at independent locations (1, 2 or 3 affiliated practices) who use a wholesale lab for processing lenses or providing other eyewear products and services were qualified to complete the survey. Respondents to the survey were entered in a sweepstakes to win a $300 American Express gift card.

Three years of data is shown for trending purposes. The 2006 survey was conducted in September via the Internet. 215 respondents at independent optical retail locations completed the survey and were offered a chance to win a $200 American Express gift card as an incentive. The 2007 survey was conducted in September via the Internet. 240 respondents at optical retail locations completed the survey and were offered a chance to win a $500 American Express gift card as an incentive.

20/20’s Lab Usage Survey 2008 was conducted during the August 18, 2008 to September 2, 2008 time period by Jobson Optical Research’s in-house research staff. The sample of 208 respondents was derived from the proprietary Jobson Optical Research Database.

The 2008 survey was conducted via the Internet and only eyecare professionals at independent locations (1, 2 or 3 affiliated practices) who use a wholesale lab for processing lenses or providing other eyewear products and services were qualified to complete the survey. Respondents to the survey were entered in a sweepstakes to win a $300 American Express gift card.

Three years of data is shown for trending purposes. The 2006 survey was conducted in September via the Internet. 215 respondents at independent optical retail locations completed the survey and were offered a chance to win a $200 American Express gift card as an incentive. The 2007 survey was conducted in September via the Internet. 240 respondents at optical retail locations completed the survey and were offered a chance to win a $500 American Express gift card as an incentive.

—Jennifer Zupnick and Megan Sahm

Jobson Optical Research

Jobson Optical Research

For more information or to purchase the entire Wholesale Lab Usage MarketPulse study, click here.