NEW YORK--The

seven largest U.S. mass merchants and warehouse clubs with optical

departments continue to gain sales as they expand their reach into

the U.S. eyecare/eyecare marketplace with additional in-store

vision centers.

NEW YORK--The

seven largest U.S. mass merchants and warehouse clubs with optical

departments continue to gain sales as they expand their reach into

the U.S. eyecare/eyecare marketplace with additional in-store

vision centers.

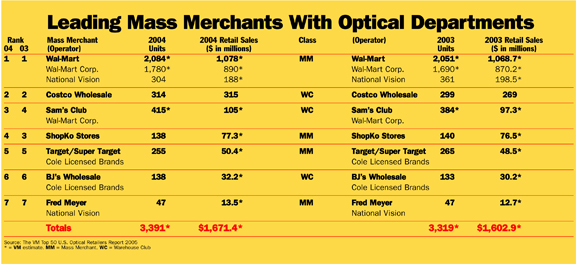

During 2004, these large national and regional retailers collectively added an estimated 72 more optical locations, bringing their combined year-end total to just under 3,400 units. (The largest increase came from Wal-Mart, which added an estimated 90 company-owned vision centers last year. National Vision, which operates leased departments inside Wal-Mart stores, had fewer of those locations at year-end, however, so the total Wal-Mart optical unit count rose by only 29.)

Overall, the mass merchants and warehouse clubs generated aggregate optical revenues that reached an estimated $1,671.4 million for 2004, up 4.3 percent over their combined estimated revenues in 2003. That 2004 volume increased their share of the total VM Top 50 Optical Retailers' combined sales to just under 28 percent, compared to a 26.3-percent share of the Top 50's combined sales for 2003.

A key change in the mass merchants' optical profile was the takeover during last years fourth quarter of the leased vision centers in Target/SuperTarget stores and BJ's Wholesale warehouse clubs by Luxottica Retail, as part of parent Luxottica Group's acquisition of Cole National's Cole Vision operation. Looking ahead to the rest of this year, the recent merger of Kmart and Sears may bring optical departments back into Kmart stores as Luxottica expands its Sears Optical retail segment.

Also, industry observers are watching to see what impact, if any, ShopKo's pending acquisition by a private equity investment firm will have on its optical operations. ShopKo expanded its optical horizons early this year by putting a vision center into one of the first three ShopKo Express Rx "neighborhood drug store locations" it opened in January.