ANDREW KARP: GROUP EDITOR, LENSES AND TECHNOLOGY

|

| John Carrier, president of Essilor of America, in his Dallas office. |

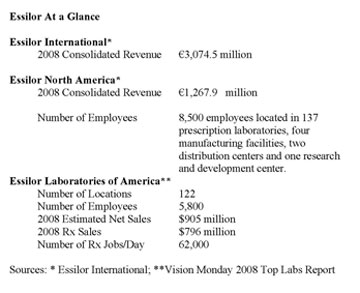

In 1996, with the establishment of Essilor Laboratories of America, Essilor became the first fully integrated optical company in the U.S., specializing in ophthalmic lens production, manufacturing and distribution in addition to wholesale optical laboratory operations. Today, it is the leading manufacturer and wholesale distributor of optical lenses in North America, with more than 8,500 dedicated employees located in 137 prescription laboratories, four manufacturing facilities, two distribution centers and one research and development center.

Through its acquisition of lab equipment manufacturers National Optronics and Satisloh, as well as lab management software companies such as VisionStar and Optifacts, Essilor can now shape the technology used to produce its lenses and coatings. In particular, the company is using its leverage to drive the market for digitally designed and surfaced lenses.

VM’s lenses and technology editor, Andrew Karp, recently sat down with John Carrier, president of Essilor of America at the company’s Dallas headquarters. They discussed a wide range of topics including digital surfacing, the expansion of Essilor’s lab network, its growing role in optometric and opticianry education and its new initiatives to raise consumer awareness about the need for proper eyecare and eyewear.

VISION MONDAY: How is Essilor reshaping its dialogue with consumers? What messages does Essilor want to send to the North American market?

JOHN CARRIER: Vision is more important than ever for consumers. Yet vision is often treated as second-class compared to other categories related to health and wellness. We invite U.S. consumers to think and care more about their eyes. You can’t live your life to its full potential if you don’t take care of your eyes. I believe you are missing something in life if you do not have five pairs of eyeglasses!

The Essilor Vision Foundation is an important way for us to bring better vision and therefore better quality of life to everyone, everywhere. We are focusing on children. Our initial work indicates that there is a large percentage of children who have uncorrected vision problems that may prevent them from achieving their full potential in life. The foundation is addressing those situations with volunteer programs such as ‘Adopt a School’ or larger scale program like ‘Kids Vision for Life.’ That’s a concept we successfully tested here in Dallas to build awareness about vision and vision problems. We’re looking at a national expansion in partnership with other industry leaders.

VM: What’s the timetable for this expansion?

JC: I would like to use the rest of this year to assemble it and make it work for 2010.

VM: How does this ‘better vision’ strategy translate into products?

JC: Our priorities are providing the market with quality performance products such as Crizal, Transitions, Varilux, Definity and Xperio that meet and exceed consumer expectations. Innovation remains key to our efforts. Also, we’re helping ECPs with education and especially ‘Needs Based Dispensing’ to help them identify all the consumers’ needs and match them with the appropriate products.

VM: Essilor is putting a lot of resources into promoting digitally surfaced lenses. How widely does Essilor want digital surfacing technology to be distributed? How quickly?

JC: We want digital surfacing to be distributed fast and everywhere. As you go farther on the experience curve, the cost comes down. If you look historically, in the mid-’90s, the American market was underdeveloped for technology, especially coating. For different reasons, Canada and Europe developed earlier.

JC: We want digital surfacing to be distributed fast and everywhere. As you go farther on the experience curve, the cost comes down. If you look historically, in the mid-’90s, the American market was underdeveloped for technology, especially coating. For different reasons, Canada and Europe developed earlier.

Today, we have to be careful we don’t get into the same situation with digital surfacing. Canada and certainly Europe are moving faster in digital surfacing. Too low a level of investment in this technology would again keep the U.S. market behind other developed markets. That’s a concern that we have. The economic crisis is a good excuse for people not to make investments they would have otherwise considered. People are too cautious.

A few years ago, the technology was not mature enough. But now it’s working well. If you do things right, you’re going to get good results. And now we’re seeing an explosion of innovation with products enabled by the technology. I think any lab should consider quickly an investment in the technology. Otherwise, there are going to be many lines of product they cannot even access.

VM: Do even small labs need to seriously consider digital surfacing? 100-job-a-day labs?

JC: I don’t know if the technology is ready for very small labs, but it’s going in that direction. It was the same with Crizal in the beginning. The technology was for bigger labs, then we made different versions, we scaled it down. I think we’re moving in the same direction with digital surfacing. I can see a case where a 100-job-a-day lab would specialize in digital surfacing and probably do better than the standard lab. It may be a little bit too early in 2009, but we need to keep the mid-term view. Remember, things are very different than they were two or three years ago.

VM: What percentage of Essilor’s PALs are now digital?

JC: I believe it’s north of 20 percent. It’s growing pretty fast. In fact, digital surfacing is growing much faster than AR coating grew. It took a good 20 years for AR coating to go from zero to 35 percent in the U.S. Digital surfacing has gone from zero to 25 percent in basically three years. That’s one of my messages. Digital surfacing is growing quickly. Don’t stay behind. Everybody wants to be careful with their investments. But it’s another thing to be too cautious and be left behind.

VM: So now it’s full speed ahead?

JC: Yes. It’s very similar to the coating situation. Two or three years ago, we could make it work, but it was difficult to get it to work from lab to lab, at a cost that was acceptable, and get reproducibility of product. Today, we’re in a place we can do that. We have the equipment, the systems, the designs. They are good and working. We have ways to make sure that what is produced every day is what is meant to be produced.

One of our concerns is similar to what happened before we introduced Crizal coatings. This thing would take off and everybody would be disappointed with the results for two reasons. First of all, you can still make pretty bad designs, old designs, using digital surfacing. Or you can actually try to do good designs, but your quality control is off, so what you get at the end of the production line is not what you intended. So you have the two pitfalls. If you do a traditional progressive with digital surfacing, it’s a waste of money and technology. If you’re using it to do the right designs and have the right quality control, I think today, as we’re proving, it works.

There is also a strong link between coatings and digital surfacing to make quality lenses. With superior coatings like Crizal some of the problems that can arise with digital surfacing, such as dispersion, can be eliminated. The result is a lens that offers total performance.

VM: Do you see the technology trickling down to mid-size and smaller labs?

JC: Yes, it’s just got to trickle down a bit faster.

VM: What is Essilor’s strategy for acquiring U.S. labs and expanding its lab network?

JC: Everywhere around the world we are looking for lab partners with good solid local labs with strong talents. Now with the economic crisis we are probably even more demanding when we look at the criteria. The price of labs is affected like all other assets in this crisis. We are taking that into consideration.

VM: Recently, Essilor has acquired and absorbed some small regional labs that service local chains and ECPs. How does that fit in with the expansion strategy?

JC: We’re looking for good local partners, good talent we complement with technology, products, programs. Often the smaller labs realize that they need help with technology. Or ECP groups realize that owning their labs constrains them in delivering the very best performance and quality options to patients and they prefer to turn the lab operations to us.

What is strategically important for me is the ability to deliver high-tech products. If we acquire a small lab that is low-tech, it is not to acquire the machines are there. What is important is that the consumer of those 15 offices and the ECP can easily, conveniently order high-tech products. The vision is to have high-tech products, coatings for instance, within one hour from every ECP.

VM: How fast is Crizal growing?

JC: When I look at the growth we’ve had with the new Crizal Avancé compared to last year, it’s about 80 percent more. It’s a worldwide success.

VM: How do Essilor-owned labs and IDD labs benefit from Essilor’s strength in lab software such as Vision Star and Optifacts. How does it impact Essilor’s digital surfacing initiatives?

JC: You’d be surprised how few labs have direct surfacing or even AR today. It’s an error not to get into it. Future products will be all direct surfaced. Not investing enough is a long-term issue for the industry, just as it was in the early ’90s for coatings. Equipment, process, design and software are strongly linked to make good direct surfaced product in a replicable way, everyday with every job.

With Satisloh, Optifacts and Essilor, we can execute this faster and we are happy to share the technology with other in an open way and help everyone grow.

VM: Essilor’s international product mix is different than in the U.S. What are some products Essilor is planning to bring to the U.S. market?

JC: We will make the Anti-Fatigue lens available this year. We’ve launched something in Europe called EyeCode. Right now, it’s mostly in Germany. The EyeCode system takes a measurement, and based on this measurement we can make a full range of new products.

It’s a very simple, patented way, to very quickly measure the center of rotation of the eye. Then, using digital surfacing, we design either a single-vision or progressive or PAL that takes into account the center of rotation of the eye, so the lenses are completely matched to the eye. The right and left eye are done separately. It’s called Dynamic 3D measurement. It can improve the precision of what we can do up to five times with less vision fatigue.

This is an Essilor exclusive. It will come to the U.S. in a few months. But it makes sense for everyplace in the world. It will deliver something better for most patients.

VM: Describe both your’s and Hubert Sagnières’s roles in managing Essilor’s North American business. How do you complement each other?

JC: Hubert has been the visionary leader for Essilor North America for almost 20 years. With Philippe Alfroid’s retirement later this year, Hubert has become the new COO of Essilor international and Xavier Fontanet [CEO] and Hubert will lead the company globally in the future. Hubert is staying very close U.S. market. In the U.S., my team and I now continue with the same values and proven strategies that have made us successful, with product and technology innovation, staying close to our customers and continue our effort increase awareness about the importance of vision for everyone. ■